Bitcoin FAQ (Frequently Asked Questions)

Bitcoin FAQ (Frequently Asked Questions) will describe you the most interesting issues of concern which were met by Bitcoin users.

Contents

General information

What is Bitcoin?

The main article: Bitcoin

Bitcoin is a peer-to-peer digital currency that can be safely and instantly sent to any person in the world. This currency is like electronic money, which you can share with friends or use to pay for your purchases.

What are bitcoins?

Bitcoin is a currency unit of Bitcoin system. Abbreviation “BTC” is usually used; it means price or number (e.g. “100 BTC”). Physical bitcoins also exist, but, generally, bitcoin is just a number connected to the address. Physical bitcoins are just objects like coins with inbuilt number.

Who invented Bitcoin?

The main article: Satoshi Nakamoto

Satoshi Nakamoto is the name used by the unknown person or persons who developed bitcoin, authored the bitcoin white paper, and created and deployed bitcoin’s original reference implementation. As part of the implementation, they also devised the first blockchain database. In the process they were the first to solve the double-spending problem for digital currency using a peer-to-peer network. They were active in the development of bitcoin up until December 2010.

How can I get bitcoins?

There are many ways to get btcoins:

- You can take bitcoins for goods or services.

- The most common way to get bitcoins is exchange.

- There are exchange services, which exchange bitcoins for conventional currency.

- You can find people in your country or city, who sell bitcoins for cash.

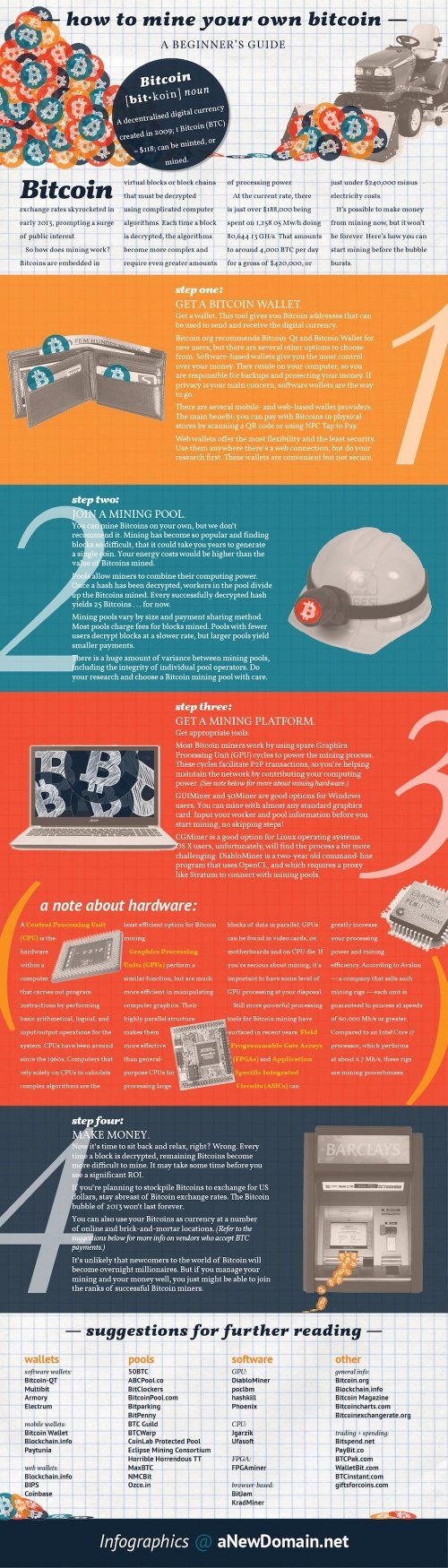

- Participate in mining pool.

- If you have a lot of equipment for mining, you can do it yourself and try to create a new block (today it brings 25 bitcoins and all commission for translations included in the block).

- Get bitcoins on websites that give them for free.

Does Bitcoin guarantee easy money?

Considering Bitcoin is a new technology, at first it can be unclear what it is and how it works. People often see Bitcoin as one of three options:

- Something like Internet scam.

- A loophole in market economy, the use of which guarantees a steady surge in capital inflows.

- Safe investment that is almost certain to bring profit.

In fact, none of these options reflects the truth. Let’s dwell on each of them.

Is Bitcoin an Internet scam?

If you spend much time online, you, probably, often meet an advertising of different scams. These ads usually promise big benefit for simple work. Such schemes are likely to be financial pyramids/matrices, which simply want to cash in on their employees and don’t offer anything worthwhile. Most often they convince people to buy certain block of shares that will bring ones pots of money. But in fact, customer has to spread more those ads without any gain. Bitcoin has nothing in common with such schemes. Bitcoin does not promise superior returns. Developers can’t cash in on you. The biggest plus is Bitcoin can’t be bought without the owner’s agreement. Bitcoin is an experimental virtual currency, which is going to be a success or fail. None of the developers expects to get rich because of it.

If I install the client, can I earn?

The majority of people using Bitcoin does not benefit from this, and client in the form it is distributed does not give you the opportunity to earn. Few people with special highly productive equipment earn Bitcoins by “mining” (creating new Bitcoins), using special software, but Bitcoin should not be considered as a path to wealth. Most users participate in this project, because they consider its concept interesting, but they do not benefit from it. Bitcoin makes its first steps. Maybe great things await it in the future, but now it’s just a technology that can be offered to the people interested in conceptual projects or new technologies.

Is Bitcoin a suitable investment?

Bitcoin is a new, interesting e-Currency, and its value is not supported by governments or organizations. Like other currencies, it is worth something, because people are willing to exchange it for goods and services. Its exchange rate is constantly fluctuating, sometimes very strong. Bitcoin lacks wide recognition; it is vulnerable to manipulation by persons without large assets. Security incidents, such as hacking a website and leakage of the accounts, can cause serious problems with uncontrolled selling of currency. There are other probable fluctuations that can trigger feedback and cause much larger changes in the exchange rate. Anyone who invests in Bitcoin, should understand the risk he takes, and consider Bitcoin as a currency with a high level of risk. Later, when the Bitcoin becomes more famous and widely recognized, it may stabilize, but at this point everything is unpredictable. Any investment in the Bitcoin must be exercised with a clear risk management plan.

Can I buy Bitcoin via Paypal?

You can buy the physical bitcoins with PayPal, but it will be more difficult and expensive with electronic coins, because of the significant risk for the seller. There is a method of buying Bitcoins via PayPal, but it is subject to a large commission. Using VirWoX you can buy Second Life Lindens (SLL) on Paypal, and then convert them into bitcoins. In such a way you lose about 6%, but will be able to get bitcoins pretty quickly, unlike a bank transfer. This method works because you do not buy Bitcoin directly via Paypal, you buy SLL (which is permissible under Paypal’s conditions), and then exchange them for Bitcoin. Despite you may find someone who wants to sell you Bitcoins via Paypal, (perhaps using # bitcoin-otc), most exchanges does not work with PayPal. It is related to the high incidence of fraud: people paid for bitcoins via Paypal, received their bitcoins, and then sent a complaint to Paypal about not getting a purchase at all. In this situation, PayPal often takes the side of the cheating buyer, so sellers have to insure against risks by higher commissions or complete rejection of Paypal. Purchasing Bitcoins from individuals is still possible, but the seller must be sure the buyer will not complain to PayPal, to get his payment back.

How new bitcoins are generated?

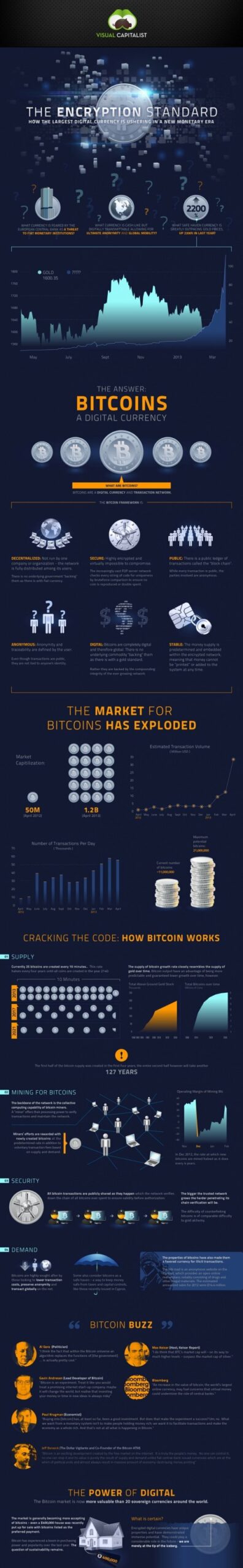

New bitcoins are generated through the “Mining” process. During the process, which is similar to a permanent lottery, hosts are awarded with Bitcoins every time they find the solution to a mathematical problem (and thus create a new block). Creation of block is a work proof and complexity of the process varies with the growth of network. Award for the creation of the block is adjusted automatically. Thus every four years of the networking half of bitcoins is created, that have been created over the past four years. During the first 4 years (January 2009 – November 2012) 10,499,889.80231183 Bitcoins (approximately) have been generated. Every four years, this amount will be divided in two; it will be equal to 5,250,000 over the next four years, then 2,625,000, and so on. Thus, the total number of Bitcoins will never exceed 20,999,839.77085749. Blocks are mined every 10 minutes on average, and for the first four years (210,000 blocks) each block contained 50 new Bitcoins. Since the amount of processing equipment used in mining increases, the difficulty of creating new Bitcoins is growing. This complexity factor is calculated every 2016 blocks; it is based on the time it took to create the previous 2016 blocks.

How much Bitcoins exist now?

Their number is constantly increasing. The number of existing coins = number of blocks, multiplied by the coin value from the block. The coins cost from the block is 50 BTC in each of the first 210,000 blocks, 25 210,000 BTC in the next 210,000 blocks, then 12,5 BTC, 6,25 BTC and so forth. How many parts bitcoins can be divided to? Bitcoin can be divided to 8 decimal places. 0,00000001 BTC is the minimum volume that can be processed in a transaction. It is also called “Satoshi” in honor of the founder of Bitcoin. If necessary, the protocol and software can be modified to work with smaller amounts.

How are called the parts of Bitcoin?

There are many disputes how to call units smaller than 1 bitcoin. The most popular options are:

- 1 BTC = 1 Bitcoin

- 0,01 BTC = 1 CBTC = 1 santibitcoin (is also mentioned as bitsent)

- 0.001 BTC = 1 mBTC = 1 millibitcoin (is also mentioned as Mbit or millibit or even bitmill)

- 0.000 001 BTC = 1 μBTC = 1 microbitcoin (is also mentioned as ubit or microbit)

Supra are international SI prefixes for hundredths, thousandths and millionths parts. Most often they argue about a separate designation for 0,01 BTC, because it is unlikely this part will be worth something as the economy of Bitcoin grows (of course, it will not be equivalent to 0,01 USD, GBP or EUR). The use of existing national symbols of money, such as “cent”, “nickel”, “dime”, “pence”, “pound”, “penny”, is not supported, too, because it is a worldwide currency.

How much is one Bitcoin?

“Satoshi” is the only exception; this word refers to the smallest existing currency face value. 0.000 000 01 BTC = 1 Satoshi, which is named in honor of Satoshi Nakamoto, Bitcoin’s inventor alias.

How will work the two timed reduced award for block, when numbers become small?

In the end reward for block declines from 0.00000001 BTC to zero, Bitcoins will be no longer created. Reward for the block is calculated as the bitwise shift of 64-bit integer to the right, so it is divided by two and rounded down. This integer is equal to BTC * 100000000, because all balances and Bitcoin cost are stored in the client as unsigned integers. If the original award was 50 BTC, then how many 4-year periods bitcoins have to be mined to reach zero? How much time it takes to create all the coins? The last block generating coins will be the block number 6929999, which should be created in 2140. The total circulating number of coins will be 20,999,999.9769 BTC. Even if permitted accuracy increases from current 8 decimal places, the total circulating number of BTC will always be slightly below 21 million (assuming that everything else will remain unchanged). For example, with accuracy of 16 after the decimal point we finally would get 20,999,999.999999999496 BTC.

If the coins are no longer created, will be the new blocks created?

Sure! Even before the coins are over, commissions for the transactions included in the blocks will certainly become more rewarding for the creation of new blocks than the coins themselves. When all coins are created, these commissions will support the use of Bitcoin and Bitcoin network itself. The number of blocks that can be created is unlimited.

But if the coins will no longer exist, what happens if bitcoins are lost?

Because of a law of supply and demand bitcoins will cost more, provided their number reduces. So if some bitcoins are lost, others will grow in price to compensate. If the value of Bitcoins increases, number needed for purchase will decrease. This is deflationary economic model. If the average transaction size is reduced, the transaction is likely to be held using Bitcoin smaller parts, such as millibitcoins («Millies») or microbitcoins («Mikes»). Bitcoin protocol uses the basic block from one hundred million Bitcoins (“Satoshi”), but unused bits allow you to work with even smaller parts.

If every transaction is transmitted through the network, does not traffic increase from Bitcoin?

Bitcoin protocol allows using lightweight clients that can work without downloading on your computer the entire transaction history. As traffic grows and this point is becoming increasingly important, methods are developed to implement such concepts. Major network nodes will become more specialized services. With the help of some changes in the software full Bitcoin nodes will be able to catch up with VISA and MasterCard, but it will require a fairly humble hardware (one high class server by today’s standards). It is worth noting that the MasterCard network structure is similar to the Bitcoin – it is also a broadcast peer-to-peer network.

Economy

Why are bitcoins so valuable? What do bitcoins have?

Bitcoins are valuable because they are useful and their quantity is limited. The cost of bitcoins will be stable depending on that how many sellers will sell wares and services using bitcoins. Here you can find the list of sites, where you can pay by bitcoins.

When we are talking that any currency is confirmed by the gold it means that theoretically you can trade this currency for gold. Bitcoins as well as euro or dollars are confirmed by nothing except sellers, who accept it.

There is a common wishful thinking that bitcoins’ prime cost increases at the expense of electricity cost, necessary for its production. Production prime cost is not equal to the cost – employment of the great quantity of the staff in order to dig a big hole is very expensive and inefficient that’s why it is not valuable. Also in spite of deficit is the most important demand for useful currency, deficit itself is not valuable. For example your fingerprints are in deficit – it is a limited quantity of it all over the world, but this fact doesn’t increase its value for other persons.

It should be also added that in spite of law of demand and supply, which is valid here, it doesn’t guarantee that bitcoins will be valuable in the future. In case there will be any confidence in bitcoins, so the fact that the quantity of bitcoins will decrease, is not important. Demand will decrease and speculators in foreign currency will try to sell it as soon as possible. Such a situation can be observed by example of state currencies in that cases when the state falls to several separate states and the currency of this state is not issued any more (as the central body issuing new money disappeared). In spite of limited quantity of money in circulation, its value decreases as the confidence in its spending power is decreasing. Of course Bitcoins system doesn’t have such a central control and issue body, but this is not a guarantee of protection from currency confidence decrease because of different unexpected factors.

Is bitcoin a soap bubble, a kind of fraud?

Yes, it is, as euro and dollars are soup bubble and a fraud. Its value consists in exchange rate and it doesn’t have any other base. If everybody won’t accept dollars, euro or bitcoins, such a bubble will blow out and the value of your savings will be zero. But such possibility is hardly probable: even in Somalia where the state has fallen to pieces 20 years ago, Somali shillings are still accepted for payment.

Do Bitcoins work according to Ponzi model?

In Ponzi scheme its founders persuade investors that they will grow rich. Bitcoin doesn’t give such guarantees. There is no central body, there only people who are building economy.

Ponzi scheme is a play with zero amount of money. Those who have been involved to the scheme earlier will grow rich at the expense of those who were involved later. Bitcoin has win-win variants. Those who began using of bitcoins earlier can get profits at the expense of bitcoins’ cost increase. Those who have been involved later and all society in general, will win due to stable, fast, cheap and widely-distributed p2p currency.

The fact that people being involved earlier will get more profits does not mean that bitcoin works according to Ponzi scheme. All reliable investments have the same features.

Whether bitcoin doesn’t bring unfair profit for those who began buy bitcoins earlier than others?

Those who began use bitcoins earlier than others take a risk of unproved technology investing. Due to their actions they help the bitcoins system become such a system it has been already became and to develop in the future. That’s why these people will get well-earned profit.

In any case each created bitcoin will change its owner scores of time as a result of exchange, so that profits from the first trade will be insignificant comparing to profits got from bitcoin currency circulation. A lot of early users of bitcoins sold their bitcoins less per 1 USD, it is significantly less than today’s cost of this currency.

Is it possible that lost cash-box and limited quantity of bitcoins can be a reason of uncontrolled deflation, which will destroy the bitcoin system?

Suspense concerning bitcoin system destroy by deflation is unreasonable. As opposed to other currencies which constantly go through the inflation because of money issue by the state, bitcoin cost will supposedly increase. Bitcoins are unique due to its limited quantity (21 million). This amount is known from the moment of project launch and bitcoins are creating very fast.

Users of bitcoins face also a danger which is unknowns for users of other currencies: if bitcoin system user lost his cash box, his money will disappear forever or until he will find his cash box. Money can disappear not only for him but also from the circulation and they won’t be available any more. As people will lost their cash boxes, the quantity of bitcoins will decrease gradually.

So bitcoins have a unique problem. While a lot of currencies go through the inflation, bitcoin will supposedly go through feedback influence. With the lapse of time bitcoins’ quantity increase will slow down. Limited quantity of this currency, being in the circulation, will decrease significantly. And as bitcoin will be less, the cost of bitcoins will constantly increase according to law of demand and supply.

So that the future of bitcoins is a kind of mystery, as nobody knows exactly what will happen to the currency which becomes even more valuable with the lapse of time. The most of economists affirm that low inflation rate is very good for currency, but nobody can be sure what happens to the currency which goes constantly through deflation. In spite of deflation isn’t a very rare phenomena, the constant deflation isn’t possible for any currency all around the world. There will be a lot of discussions of this process, but there is no experience of such model work all around the world, that’s why all affirms of economists are just guess works.

In spite of all above there is a mechanisms intended for the fight with clear consequences. The majority of currencies can be unpractical due to too strong deflation. If it is possible to buy a new car per 1 Canadian USD, so what should Canadian do when they would like to buy bread or candy? Even a penny will be very valuable. There is a simple decision for this in the bitcoins system: endless divisibility. Bitcoins can be divided and sold by such tiny parties, as it will be comfort for the owners. So it doesn’t matter how valuable bitcoins are, they can be used by people for transactions of any volumes. Generally endless divisibility should allow bitcoins to exist even in cases when a lot of people lost their cash-boxes. Even if there will be just 1 bitcoin all over the world or even its part, so bitcoin can exist. Today is too early to say about possibility of such events, but deflation constitutes likely less menace that a lot of people suppose.

And if somebody buys all bitcoins, which exist?

Bitcoins’ markets are based on competition and it means that the cost of bitcoins will increase or decrease depending on supply and demand on certain price level. Just little part of bitcoins, which exists nowadays, is available for sale on foreign exchange market. So in spite of byer with a lot of money has a technique opportunity to buy all bitcoins available for sale, so he has to wait when all other holders of bitcoins offer it for sale. So that even the most rich and resolute buyer can’t get all bitcoins.

Moreover new currency is issued every day and it will continue during ten years; thought issue speed will decrease insignificantly with the lapse of time. People dealing with mining are not obliged to sell their bitcoins that’s why on the market all currency won’t be available. But such a situation doesn’t guarantee that markets are invulnerable for prices manipulation. Insignificant volume of the currency is demanded in order to decrease or increase its market-value that’s why bitcoins is unstable assets.

And if somebody creates a new chain of blocks or digital currency which will force out bitcoin?

One of the most important mechanisms of bitcoins’ safety is based on that it’s very difficult to branch the chain of blocks. Choosing between two chains miner usually chooses the longest one, it means the chain with the difficulties hash. In such a way we get guarantee that each user can spend his bitcoins one time only and the fraud is excluded. The structure of the block chain is created in such a way that there are a lot of branches and there is a probability that the deal will be rewritten by the longest branch in case itself was in the shortest one. With the deal age the probability about its rewriting decreases and there is a chance that it will be constant. Though thanks to blocks’ chain structure people won’t be able to spend more bitcoins then they have. It is a probability that it will be accidently cancelled.

The new blocks’ chain will make a network more vulnerable to attacks of double payment. Nevertheless the creation of new chain is a very difficult process so such a risk is not significant.

Bitcoin will always choose the longest blocks’ chain and it will determine comparative length of two branches according to its hashes’ complexity. As a hash of each new block is created on the base of the previous one, so by creation of the block with more complex hash it’s necessary to be ready to make more calculations then it was made by the network from the moment of offshoot and till new block creation. It stands to reason that powerful computing power is necessary and as bitcoin increases constantly and gets widen so this index will increase.

The possibility of appearance of other more perfect virtual currencies which can force bitcoin out and make it outdated and useless constitutes a menace.

Bitcoin development demanded serious intellectual resources and ingenuity, but this currency has become the first sui generis, it became a prototype, vulnerable before more developed competitor, but there is no guarantee that it will save its position. If historical principles of Internet operate, so analogous system based on the same principles, will change and pass ahead of bitcoin, when its main defects will be shown. Friendster and Myspace ware damaged in such a way because of Facebook, Napster has been thrown down by Limeware, Bearshare and torrent applications and Skype has been smashed by Microsoft Messenger.

It is possible that it sounds gloomy so keep in mind that appearance of new and possibly better virtual currencies doesn’t predict bitcoin’s demise. If bitcoin gets its sure footing and wide recognition and it confirms its stability how private online currencies of the next generation will be created, so the future currencies even with the better architecture won’t constitute a menace. It is called a network effect.

Do prices manipulations are possible in Bitcoins?

Nowadays low market capitalization of bitcoin means that any investor with enough quantity of money can significantly change/manipulate the rate. Is it a problem?

It is a problem but in the case when you are investing in bitcoins for short period of time. Manipulator can’t change the main principles based in the system that’s why during 5-10 years these principles will overcome any short time manipulations.

Payments’ sending off and receipt

Why should I wait for 10 minutes in order to spend money I have got?

10 minutes is an average period of time for block search. This process can take significantly more or less time; 10 minutes is just an average meaning.

With the help of the blocks (known as a “confirmation” in Bitcoin graphical interface) the Bitcoins system matches what does anybody have? After the block has been found everybody agrees that you have these coins so that it is possible to spend them again. Until it is not found some network units can have outdated information and it can make a fraud of the system more possible by returning the transaction. The more confirmations have a transaction the less risk of refund is possible. 6 blocks and 1 hour are enough in order to make a refund unpractical in terms of calculations. And measures are much more better that they are by Credit cards where charge backs can be possible during 3 months from the moment of the first deal!

10 minutes period of time has been chosen by Satoshi as a compromise between the moment of the first confirmation and work volume, wasted for working out of the branched chain. If the block is received so other miners don’t know about it at once and until they compete with a new block bit not account on its base. If anybody mines a new block on the base of the old chain, so the network will accept just one of them and all computing work will be wasted. For example, if miners know about new blocks per 1 minute and new blocks appear every 10 minutes, so 10% of the network operation will be wasted. Time increase by accepting a new clock decreases this process.

Lets’ imagine that bitcoins system achieves a Mars. If planets are on the distant points of their orbits, so the signal needs 20 minutes in order to get each other. On condition that the search of the new block takes 10 minutes, miners on the Mars will drop for 2 blocks behind the miners on the Earth. They almost can’t create blocks by themselves. In case we had to work with such delays so the time of receiving of a new block should be increased at least several hours.

Should we wait for transaction confirmation in order to buy or sell wares by bitcoins?

Yes, you should, in case transactions can’t be carried out in reverse direction. Software intended for work with Bitcoin doesn’t confirm transaction until 6 blocks (confirmations) more will be found. It is very difficult to cancel transactions when they are at the big distance in the chain. But it is very easy to do before the first confirmation. If transaction can’t be made in reverse direction, it is recommended to get 2-6 confirmations depending on the sum of transaction.

When people ask this question, they usually think about bitcoins’ usage for example in super markets. Such transactions can be made in reverse direction: if somebody tries to use money twice, it can work several times, but as a result one from such deals will be noticed and penal consequence in the shop in majority countries is much more serious than income from such a theft.

Spheres of usage which demand immediate work out of the payments, for example, it is necessary to protect super markets or coin-operated machines from such risks. There is a way how you can return unconfirmed payment:

“Attack of Finni” consists in block mining by trespasser, which has a refund of certain quantity of coins. As soon as he finds the decision he does his shopping very fast and then it relays a block, accepting in this way coins back. First of all such an attack is very dangerous for wares directly, which are being sent at once, for example music tracks and currency at exchange. As a trespasser can’t choose a time for attack, it is not important for the shops where you can’t choose when exactly to pay (for example because of queues). Attack can be failed in case somebody else will find a block consisting dealing about this purchase before you create your own block. So organization dealing with bitcoin can decrease a risk just asking a seller to wait a little bit.

As this attack is difficult enough, sellers selling wares automatically and instantly should correct their prices in order to include the cost of such a fraud or special insurance.

Bitcoins have been already sent to me, but I did not receive it yet! Where are my bitcoins?

Don’t panic! There is a range of reasons why you can’t get your bitcoins and there is a range of ways of these reasons’ definition.

The last version of Bitcoin-Qt customer shows how much time we need in order to download the block chain. Just aim a cursor at the sign located in the right low edge in order to know the status of your customer. You can also check a status of your transaction on Blockchain.info site, just having made a search according to your address. If there is a deal in the list, so you have just to wait a little bit until it will be on and will be reflected in your customer. If in the deal is used a coin, by which has already been made a transaction, so it can have a low priority. Transaction can take more time in case paid commission was low. If there was any commission at all so transaction can get very low priority and it will reach a block just in several hours and even days.

Why my Bitcoin address changes constantly?

In spite of postal and e-mail addresses, Bitcoin one is used just one time. It means that each time when you receive a transaction you have to generate a new address.

Though technically it is possible to get coins several times on the same address, it endangers safety of your cash-box and confidentiality of Bitcoin network and it makes also impossible to determine those who has sent coins and why.

How much will be commission?

In order some dealings get a confirmation; a certain commission should be paid. Commission is worked out and received by miner. The latest version of Bitcoin customer evaluates upon necessity an appropriate commission.

Commission is added to the payment sum. For example, if you send 1234 BTC and a customer demands a commission 00005, so 12345 BTC will be withdrawn from your account and a receiver will get 1234 BTC.

Commission can also be obliged, because dealing looks like an attack at the Bitcoin system. For example it can be difficult to carry dealing out in case there are recently used bitcoins. Your cash-box tries to avoid generation of onerous transactions but it is not always able to do it: means in your cash box can be new and can consist from the majority of tiny payments.

As commission depends on data quantity, from which dealing consists but not from the quantity of sent bitcoins, it can be very low (0.0005 BTC for 1000 BTC) or unfairly high (0.004 BTC for 0.02 BTC it’s about 20%). In case you are getting insignificant sum of money (for example payments from mining pool) so commission by sending will be higher than by conduction of ordinary consumer and business operations.

What is happening when somebody sends bitcoins to me, but my PC is off?

Bitcoins are not just being sent to your cash-box; the program uses such term in order we can use a currency without studying of new notions. Your cash-box is necessary just in case you would like to spend your coins.

If somebody has sent coins to you while your customer was off, and you launched a program later, so coins will receive your account at once. So when your customer is being launched, it downloads blocks and knows new dealings including those applying your cash-box.

How much time lasts a synchronization while the first establishment of Bitcoin customer? What is happening during this process?

A popular Bitcoin customer from the bitcoin.org works as a full Bitcoin unit: it can do all duties of Bitcoin system; it is not just a customer. One of the principles on which the work of the full Bitcoin units is based consists in not following the rules by Bitcoin system participants. While the synchronization the software works out carried out dealings and checks by itself whether all rules were followed correctly.

Usually after synchronization finish, the program uses tiny quantity of PC sources.

While the first establishment of customer-cash box, its prime check demands significant activity of the hard disk, so that synchronization duration depends on disk and processor speed. It can take from the several hours till several days etc. More than 40 hours can be necessary for constant synchronization on the slow PC, so check energy conservation settings of your PC in order to be sure that it won’t off hard disk in case it will be without tending for several hours. While the synchronization you can use Bitcoin customer, but you won’t see your last payments till the customer gets the points of their conduction.

You can try alternative easiest customer – a kind of Multibit or super-easy electrum customer, though they are not well protected and are a little bit unfinished and don’t fix P2P network.

Network

Should I set my firewall in order to launch Bitcoin?

Bitcoin will be connected to other units using as a rule TCP port # 8333. In case you would like a Bitcoin customer was connected to majority of units, it is necessary to allow outgoing TCH connections thrpugh the port # 8333. Testnet uses TCP port # 8333.

If you wants to restrict rules of firewall for several IP-addresses, so it is possible to find stable units n the list of reserve units.

How works a mechanism of feasts’ finding?

Bitcoin finds feasts by sending messages inside its own network and each unit saves data base of famous feasts in order to use it in the future. In order to support this process, Bitcoin needs the list of the prime feasts. This list can be made manually, but usually the program gets this information with the help of the request of domain DNS names with automatically renewed lists. If it doesn’t help, the program uses built-in list, which is renewed sometimes in new versions.

Mining

What is it?

Mining is a process of usage of computing power necessary for implementation of new bitcoins in the system and for protection from the refunds.

Mining is a computing of the block hash, which includes reference on the previous blocks, hash of carried out operations and disposable number. If the meaning of the hash is less than current goal (which is inversely to the complexity), so new block is being created and miner gets created bitcoins (at the moment 24 BTC per one block). If hash is more than the current goal, so new number is used and new hash is being accounted. Each miner does it millions times per the second.

Is mining used for conduction of useful calculations?

Mining calculations concern bitcoin only and are not connected with other distributed computing projects. They serve in order to provide safety of Bitcoin system, what is rather useful.

Is it a waste of electricity?

We can’t say that expense of electricity necessary for creation and providence of free standard is waste. Moreover services necessary for operating of widely-distributed nowadays standards (banks and credit companies) also spend an energy even more than Bitcoin.

Why can’t we use calculations, which can be also applied for other aims?

In order to provide safety of the Bitcoin network, calculations inside it should have some peculiar features. These peculiarities are incompatible with calculations intended for other goals.

How can we prevent miners from creation of the blocks without transactions?

Commissions for transactions are stimulus for miners. In case we need to realize some minimum quantity of transactions in the block, miners would enter this number. As the network growths a commission for block creation decreases and miner become more dependable on commissions which can compensate its costs, that’s why the problem of zero blocks without transactions will tail with the lapse of time.

How the principle “confirmation of carried out work” helps to protect Bitcoin?

Bitcoin uses the principle of confirmation of carried out work Hashcash with insignificant adoptions. In order to get general idea about mining process, just imagine such a source code:

Payload = defined data related to running process in the Bitcoin network One-time number “nonce” = 1 Hash = SHA2 (SHA2 (payload + one-time number))

Work made by miners consists in repeated increase of “one-time number” until hash-function gives a rare meaning which is low than certain goal threshold level. (by other words, hash begins from the certain quantity of zeroes, in case you represent it by the fixed length).

So you can see that there are any peculiar calculations by mining. Miners just try to find some number (so called one-time number) which (in aggregate with payload) will make a hash with peculiar features.

Advantages of usage of such mechanism consist in easiness of inspection results. Taking into account payload and specific one-time number, just one hashiring call for hash properties inspection is necessary. As hashes can be found just with the help of brut forces (it is a method of search of any possible variants)so it can be used as a confirmation of carried out work, because we see that somebody has used great computing powers in order to find right temporary meaning (one-time number) for payload. This function is being used in Bitcoin system in order to provide safety of different its aspects. A trespasser who wants to punch harmful data in the network should provide necessary confirmation of the work. And until honest miners have more computing powers, they will always pass ahead.

Safety

Can miners come to an arrangement with each other in order to take money or to change all work of Bitcoin system?

There are two questions. Let’s see them separately.

Can miners unite and take money?

Mining – is a process of creation of new blocks in the chain. Each block includes the list of all transactions made in Bitcoin network from the moment of creation of the last block and also hash of the previous block. New blocks are produced i.e. generated by Bitcoin clients, whose function consists in guessing of the last symbols in the codes, which are named hashes and are created with the help of information from the previous blocks. Bitcoin users can download special programs for mining with the help of which you can single out certain quantity of computing power for guessing on the base of the hash of the previous block. Those who will be the first who make the right calculation cresting a new block will get bitcoins as a kind of compensation.

Blocks’ chain is one from the two structures, which supply safety of Bitcoin. Another one is a system of encoding with the open key on which the trade is based. The chain of the blocks not only gives a guarantee that all dealings will be written down but also allows to any person to keep notes about any dealing. A lot of users have a list of all carried out dealings for the whole history of Bitcoin, this list is available at any moment and any who wants to get information can do it without any efforts. So it is difficult to fraud in Bitcoin system.

Bitcoin system launch demands significant computing powers and as a great power allows making more attempts concerning numbers’ guessing , so people who have made more investments to PCs, will earn much money. Today each guessed number gives 25 bitcoins, which are valuable (though their cost varies), so any miner who earns bitcoins gets money. Some makes it alone, other participate or create pools where each brings profit.

So on the first question we will answer “yes” – miners can not only come to an arrangement in order to get more money, the system itself encourages it. Pools are collective structures there is nothing unfair or crafty. Of course the main question is:

Can they do it on circumvention of existing rules of Bitcoin system? Is there any way to sack and earn a lot of money unfairly?

Bitcoin is not perfect. The system can be deceived, but it is very difficult to do. Bitcoin has been developed in order to avoid main problems of contemporary currencies, i.e. that the degree of belief depends on people who not always assign primary importance to interests of currencies holders. Each currency in the world (except Bitcoin) is being controlled by the large establishments, which are controlling operation with these currencies and can manipulate its cost. Currencies have a certain cost because people believe in establishments controlling these currencies.

Bitcoin doesn’t ask about belief to any organization. System safety is based on the cryptography, which is its integral part which is available. Instead of creation of new separate organization which will control transactions, the whole network controls it, that’s why it is very difficult to steal bitcoins or make a fraud by any other ways. Bitcoins are being created regularly and predictively. A lot of users create it that’s why nobody separately can create too much bitcoins in order to decrease its value. Bitcoins are created in such a way in order to be protected from inflation and repeat usage (double-spending). The system is widely distributed.

Nevertheless there are several ways you can use in order to get bitcoins unfairly. Firstly, personal keys can be stolen. Keys’ theft isn’t included to the list from which bitcoin system is protected. The storage of the keys depends on users only. But cryptographic protection in the system is settled in such a way that nobody can get personal key of the person even if somebody knows his public key. Until you use personal key individually you should not worry. There is also a theoretical possibility of creation of new blocks’ chain, but because of peculiarities of the building of such chains this task will be very difficult and will demand huge computing powers. The full description of such difficulties can be found in the article devoted to the chain of the blocks.

The Bitcoin system can be broken, but it is very difficult to make such actions and they will demand experts’ involvement and stunning volumes of computing power. The bitcoin system is not absolutely inaccessible, but it is very close to perfection.

Can miners change Bitcoin features?

We will tell you one more time – no.

Bitcoin is a widely-distributed network that’s why any changes included to the system should be approved by all users. If somebody wants to change the way of creation of Bitcoins, it is necessary to convince each bitcoin holder to download and use some software, that’s why changes can be made just in case it will be of benefit to all.

In such a way it is almost impossible to change the work of the Bitcoin system for personal enrichment. If users don’t like the changes they won’t accept it. And if they like these change, it will be in profit of all users. Of course we can imagine the situation that somebody will make such changes which won’t be noticed by anybody and that will be in profit of somebody specifically and not to all. But the system is made easy enough, and significant changes can’t be unnoticed.

The fact that serious changes are difficult to be involved proves that Bitcoin is absolutely distributed system. Any currency is being controlled from the center and it can be changed from this center without approval of the currency holder. Such a central body is not provided in the Bitcoin system, that’s why all changes are made according to society will. Bitcoin development is a reflection of the collective evolution – the first experience in the whole world for monetary unit.

How to Invest in Bitcoin?

Why Invest in Bitcoin?

- It seems silly to some people that one bitcoin can be worth hundreds of dollars.

- Bitcoins are scarce and useful.

- Let’s look to gold as an example currency. There is a limited amount of gold on earth.

- As new gold is mined, there is always less and less gold left and it becomes harder and more expensive to find and mine.

- The same is true with Bitcoin.

How to Invest in Bitcoins and Where to Buy?

The difficulty of buying bitcoins depends on your country. Developed countries have more options and more liquidity.

Coinbase is the world’s largest bitcoin broker and available in the United States, UK, Canada, Singapore, and most of Europe.