The DAO

Decentralized autonomous organization (DAO) was a digital organization and a form of investor-directed venture capital fund. It was instantiated on the Ethereum blockchain, and had no conventional management structure or board of directors. The DAO was stateless, and not tied to any particular nation state. As a result, many questions of how government regulators would deal with a stateless fund were yet to be dealt with. The Decentralized Autonomous Organization was crowdfunded via a token sale a different type of crowdfunding effort in May 2016. It set the record for the largest crowdfunding campaign in history.

Contents

Decentralized Autonomous Organization Review

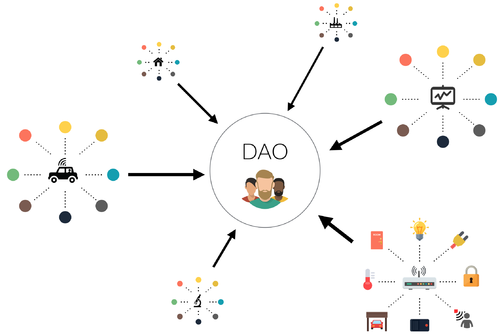

The DAO was focused on projects related to the sharing economy and Internet-of-Things (IoT) applications of the blockchain – though the organization said it is interested in exploring other “new markets unlocked by blockchain technology. ”The DAO is a Decentralized Autonomous Organization (“DAO”) – more specifically, it was a new breed of human organization never before attempted. The DAO was borne from immutable, unstoppable, and irrefutable computer code, operated entirely by its members, and fueled using ETH which Creates DAO tokens.

In June 2016, users exploited a vulnerability in the DAO code to enable them to siphon off one third of The DAO’s funds to a subsidiary account. On 20 July 2016, the Ethereum community decided to hardfork the Ethereum blockchain to restore virtually all funds to the original contract. This was controversial, and led to a fork in Ethereum, where the original unforked blockchain was maintained as Ethereum Classic, thus breaking Ethereum into two separate active blockchains, each with its own cryptocurrency.

The DAO was delisted from trading on major exchanges such as Poloniex and Kraken in late 2016.

History of DAO

The computer code behind the organization was written by Christoph Jentzsch, and released publicly on GitHub. and more than -worth of Ether (ETH)—the digital value token of the Ethereum network—by 12 May, and over by 15 May 2016. On 17 May 2016, the largest investor in the Decentralized Autonomous Organization held less than 4% of all DAO tokens and the top 100 holders held just over 46% of all DAO tokens. The fund’s Ether value was more than , from more than 11,000 investors.

As of May 2016, The DAO had attracted nearly 14% of all ether tokens issued to date.

Since 28 May 2016 the Decentralized Autonomous Organization tokens are tradable on various cryptocurrency exchanges.

A paper published in May 2016 noted a number of security vulnerabilities associated with The Decentralized Autonomous Organization, and recommended that investors in The DAO hold off from directing The DAO to invest in projects until the problems had been resolved. On June 16 further attention was called to recursive call vulnerabilities by bloggers affiliated with the IC3.

On June 17, 2016 The Decentralized Autonomous Organization was subjected to an attack that exploited a combination of vulnerabilities, including the one concerning recursive calls, and the user gained control of 3.6 million Ether, around a third of the 11.5 million Ether that had been committed to The DAO; the affected Ether had a value of about $50M at the time of the attack. The funds were put into an account subject to a 28-day holding period under the terms of the Ethereum contract so were not actually gone; members of The Decentralized Autonomous Organization and the Ethereum community debated what to do next, with some calling the attack a valid but unethical maneuver, others calling for the Ether to be re-appropriated, and some calling for The DAO to be shut down.

In September 2016 Poloniex de-listed DAO trading pairs, and in December 2016 Kraken also de-listed the token.

Operation

The DAO was a decentralized autonomous organization it did not have a physical address, nor people in formal management roles.

As a blockchain-enabled organization, The Decentralized Autonomous Organization claimed to be completely transparent: everything was done by the code, which anyone could see and audit. However, the complexity of the code base and the rapid deployment of the DAO meant that the intended behavior of the organization and its actual behavior differed in serious ways that weren’t apparent until after the attack occurred.

The Decentralized Autonomous Organization was intended to operate as “a hub that disperses funds (currently in Ether, the Ethereum value token) to projects”. Investors received voting rights by means of a digital share token.

New empire

We could have companies without CEOs or hierarchy. The uses for such an infrastructure are tremendous in scale. If regulatory structures permit, blockchain data could replace many public records like birth certificates, marriage certificates, deeds, mortgages, titles, sex offender records and missing persons. Healthcare clinics can function autonomously, cab companies can control a fleet of driverless cabs, a software development company can employ thousands of independent programmers. The list is quite large and a DAO model can be applied to almost any business[1].

Examples of real world DAO projects are The DAO company, Digix.global and the cryptocurrency Dash. The idea behind Decentralized Autonomous Organization companies is that the rules upon which the company functions are enforced digitally. Other decisions are made by shareholders who control a certain amount of the tokens, or smart contracts, who can vote for decisions. Preprogrammed rules describe what can happen in the system. Certain rules are hard-coded into the company like the amount of dividend payouts or determining a certain event in the company. Other things like, determining which project will receive money is decided by letting all token holders cast their vote[2].

What is a decentralized organization?

The DAO was a new type of organization that is best described by comparison with a digital company that was not associated with any legal entity. Created with immutable code, it was managed exclusively by the community of investors who have invested in it in the form of ETH (tokens that Ethereum operates on) and exchanged them for special DAO tokens.

According To Slock.it, the DAO had 4 characteristics.

- absolute impartiality in the selection of participants. Using The implementation of Ethereum’s smart contracts, the DAO allows those from around the world to participate in the management of the common Fund. The participants who supported the project receive Decentralized Autonomous Organization tokens for their subsequent use in voting and other activities of the company.

- flexible structure. This is manifested in the fact that the principle of the organization allows to support proposals of any nature, whether it is the creation of a useful product, investing in venture projects for profit or their direction to charitable needs (whale rescue is already offered). Participants can vote for the allocation of funds for proposals of an innovative nature, the further practical implementation of which will be borne by the involved performers[3].

- developing in the framework of the project products or services. The fee charged to the clients and the potential profit (in ETH) can be directed to further growth of the organization or simply converted into DAO-tokens and distributed among the project participants.

- The Decentralized Autonomous Organization is a fair decentralized management model. Slock Command.it promises that the DAO Ethereum-owned tokens will never be centrally managed. Holders of Decentralized Autonomous Organization tokens have the right to vote in important decisions related to the management of the organization or projects, including the possibility of ETH redistribution among the participants.

Security

It’s easy to see why “unstoppable code” could pose a security problem. Today, it’s difficult to change a DAO, or the smart contracts underpinning it once it’s deployed to the ethereum blockchain. This is “good,” because one person or entity can’t change the rules. But it’s also potentially a huge disadvantage. If someone spots a bug in a running DAO, developers can’t necessarily change the code.

That was the problem with The Decentralized Autonomous Organization. Observers watched the attacker slowly drain of funds, but they couldn’t do anything to stop it. (Technically, the hacker was following the rules as they were deployed). Ethereum’s lead coders reversed the transaction history to return funds to their owners, which was a controversial decision leading to a rift in the community. The best way to handle a similar future situation is still up to debate[4].

Risks

In May 2016 the plan called for The DAO to invest Ether in ventures it would back (contractors) and to receive in return “clear payment terms” from contractors. The organizers of the DAO promoted the DAO as providing investors in the DAO a return on their investment via those “clear payment terms” and they warned investors there is “significant risk” that the ventures funded by the DAO may fail.

Risks included unknown attack vectors and programming errors. Additional risks noted included the lack of precedence in regulatory and corporate law; how governments and their regulatory agencies would treat The DAO and contracts it made was unknown. There was also a risk that there would be no corporate veil protecting investors from individual legal and financial liability for actions taken by The DAO and by contractors in which The DAO invested.

Proposals

Slock.it (a German IoT venture), and Mobotiq (a French electric vehicle start-up) were listed as seeking potential funding on the daohub.org website during the May “creation period”. Both Jentzsch brothers are involved in Slock.it as well.

Critics of Decentralized Autonomous Organization

The importance of many amazing and revolutionary inventions is often overestimated. MIT Technology Review magazine considers the idea to trust the masses quite risky. After all, even if experienced, educated and pulse-holding venture capitalists are not always able to choose the right startup for profitable investment, what can we expect from a motley crowd, most of which has nothing to do with investments?

Another point is related to the platform on which the DAO works. The “wise crowd” of people who supported The DAO can be so absorbed by the hype around ETH that the choice of projects to support will begin to give preference to Ethereum and related ideas, the usefulness of which, according to experts, has not yet been proven.

Moreover, DAO’s broad success depends largely on whether ETH can become a popular means of paying for products and services. Regardless of the degree of autonomy, the Decentralized Autonomous Organization will have to involve, one way or another, third-party organizations that conduct their financial Affairs in traditional currencies. Payment for their services will require the conversion of ETH tokens, which will certainly create for the organization some additional inconvenience in communicating with the rest of the world.

Tim Swanson, R3CEV market research Director, shared his interesting thoughts on the disadvantages of The Decentralized Autonomous Organization:

“… The Decentralized Autonomous Organization (DAO), in fact, is an investment Fund. However, many people see it as lying on the bottom of the ocean, stuffed with gold storage, the value of which somehow unknown ways should grow one day, and they, in turn, should benefit from it. Of course, we will always be able to observe these funds lying “there at depth”, but someone still have to give DAO-tokens real value to extract at least some profit from the project.”

External links

- Wikipedia.org – The DAO (organization)

- BlockchainHub – DAO

- How to build a democracy on the blockchain

- Cryptocompare – The DAO hack