Bitcoin Emission

Bitcoin was designed as a decentralized, limited-supply cryptocurrency. Deflation is a possible consequence of its limited supply. Maximum amount of Bitcoins is 21 Bitcoins in 2140.

Contents

Decentralization

A crucial characteristic of bitcoin is that it is a decentralized currency, unlike the USD or the JPY, which are centralized. Centralized currencies are controlled and issued by central state banks in an amount commensurate with the amount of goods and services produced in an economy. Central banks conform to a state’s monetary policy, by which they control the supply of money and ensure price stability. They increase the country’s monetary base by issuing currency and increasing money stock in the process of quantitative easing.

In contrast, a decentralized system like Bitcoin prohibits human interference in the issuing of currency. The process is completely under the control of a cryptographic algorithm that follows the rules of a peer-to-peer (P2P) blockchain. This algorithm determines the frequency, specific time, and number of issued currency units. Furthermore, the system cryptographically rejects any attempt to change or crack the data on the number of issued currency units that does not conform to the rules of the entire blockchain. Because of this, it is possible to verify transactions without having to synchronize the entire blockchain.

Limited Supply

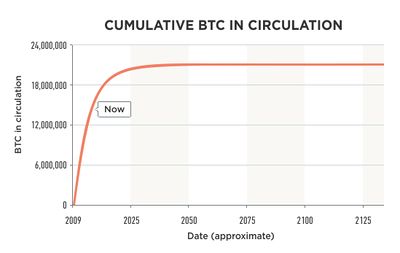

Sets of bitcoins are created as reward (called a block reward) for miners or mining pools who successfully mine a block. New blocks are added to the blockchain at a fixed frequency of six blocks per hour, or every ten minutes (this is the difficulty rate). The amount of bitcoins issued as reward in each block is halved every 210,000 blocks, or approximately every 4 years. This entails that the supply of bitcoin is finite; there will only ever be 21 million bitcoin in existence. In 2008, block rewards were set to issue 50 bitcoins; in November 2012 this amount became 25 bitcoins, and in July 2016 it became 12.5. Following this schedule, it is estimated that the last bitcoin will be mined in the year 2140, when the cap of 21 million bitcoins is reached. Thus, like with gold, the supply of bitcoin depends on the mining process, rather than on the demand for it.

Deflation

Since the total amount of bitcoins cannot be artificially increased, the currency will experience deflation if its use becomes widespread. Keynesian economists argue that this would lead to a deflationary spiral for bitcoin: its constantly rising exchange rates would motivate people to hoard the currency without ever spending it, which would in turn fuel the deflation, negatively affecting economic growth.

However, economists of the Austrian School claim that, because deflation occurs at all levels of production, investors can actually benefit from it. In other words, in a deflationary environment the price of goods and services decreases while the cost of their production decreases proportionally, leaving profit ratios intact. At the same time, demand is not affected. Price deflation encourages people to save money, and the increase in saving funds leads to lower interest rates and an increase in capital, creating incentive for entrepreneurs to invest.

How many Bitcoins are left?

There are currently close to 4.3 million Bitcoins left that aren’t in circulation yet. With only 21 million Bitcoins that will ever exist, this means that there are about 16.7 million Bitcoins currently available. Out of those 16.7 million, it’s estimated that 30% of those may be lost forever as a result of things like hard drive crashes and misplaced private keys.How many Bitcoins are left?