Blockstate

BlockState is a Swiss based company building the technological and legal foundation to create new solutions for banking, specializing in Distributed Ledger Technology (DLT) based products for asset management, debt markets (loans and bonds), and derivatives. Company solutions aim to substitute antiquated parts of the existing infrastructure to bring efficiency gains that translate into direct cost savings by eliminating intermediaries and opaque processes.

Contents

BlockState verticals

Asset management

BlockState is creating the future of digital asset management by offering a solution to tokenize illiquid assets, and making digital assets accessible to investors through existing market infrastructure as Exchange Traded Products (ETPs). This dual approach allows to spearhead the creation of new investment products for the emerging asset class of crypto currencies and provide more liquid investment solutions. The tokenization of illiquid assets (e.g. real estate funds) enables fund providers to offer liquidity to existing investors and access to new investors.

CTF15 Index Fund tracks the performance of the largest 15 cryptocurrencies by market capitalization. Bridging a smart-contract, digital asset basked to a fully securitized, traditional financial instrument enabling maximum transparency and security of the held NAVs. It uses a unique transparent, open-source pricing via DIA and has a minimum investment of EUR 10,000.

Tokenised debt instrument

Issuance of debt instruments like bonds and syndicated loans is strictly formalised process which require a complex cooperation between third parties and intermediaries in order to enable issuance and trading. Blockstate is providing a platform to create and sell bonds directly on the platform as well as to enable incorporation of all the corporate events and regulatory changes that have influence on the financial instrument.

Smart contracts for Illiquid derivatives

Building a smart contract platform for Illiquid OTC derivatives to minimise the costs that are occurred in traditional derivative market due to manual contract handling and high counterparty risk. Smart contracts are used for automating manual processes, clearing and collateral management.

Open technology and legal infrastructure

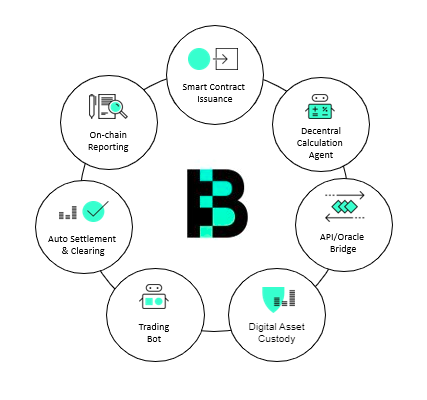

BlockState provides a combination of easily accessible and versatile market infrastructure modules and services. They have developed the legal and tech modules and services in order to be used in different set-ups and configurations. They BlockState and their partners to create products by combining the different modules as needed.

Executive Team

Paul Claudius

Managing Director

Serial entrepreneur and crypto investor with 10+ years of experience scaling disruptive businesses and category leaders across Europe.

Michael Weber

Managing Director

Former investment banker, serial entrepreneur and crypto currency veteran with deep understanding of financial legal frameworks.

Samuel Brack

Chief Technical Officer

Seasoned expert in crypto currencies and distributed algorithms. Member of the computer engineering group at Humboldt University of Berlin.

Carl Bruns

Chief Marketing Officer

Operations and marketing specialist. 10+ years of operational experience founding, supporting and developing ventures.

Andre Voinea

Executive Director

Veteran executive with extensive experience in ETF structuring, asset management, strategic sales and account management.