Digital currency

Digital currency (digital money or electronic money or electronic currency) is a type of currency available only in digital form, not in physical (such as banknotes and coins). It exhibits properties similar to physical currencies, but allows for instantaneous transactions and borderless transfer-of-ownership. Examples include virtual currencies and cryptocurrencies or even central bank issued “digital base money”. Like traditional money, these currencies may be used to buy physical goods and services, but may also be restricted to certain communities such as for use inside an on-line game or social network[1].

Contents

What is Digital currency?

In 1983, a research paper by David Chaum introduced the idea of digital cash. In 1990, he founded DigiCash, an electronic cash company, in Amsterdam to commercialize the ideas in his research. It filed for bankruptcy in 1998. In 1999, Chaum left the company[2].

In 1997, Coca-Cola offered buying from vending machines using mobile payments. After that PayPal emerged in 1998. Other system such as e-gold followed suit, but faced issues because it was used by criminals and was raided by US Feds in 2005. Q coins or QQ coins, were used as a type of commodity-based digital currency on Tencent QQ‘s messaging platform and emerged in early 2005. Q coins were so effective in China that they were said to have had a destabilizing effect on the Chinese Yuan currency due to speculation. Recent interest in cryptocurrencies has prompted renewed interest in digital currencies, with Bitcoin, introduced in 2008, becoming the most widely used and accepted digital currency.

Digital currency is a money balance recorded electronically on a stored-value card or other device. Another form of electronic money is network money, allowing the transfer of value on computer networks, particularly the Internet. Electronic money is also a claim on a private bank or other financial institution such as bank deposits.

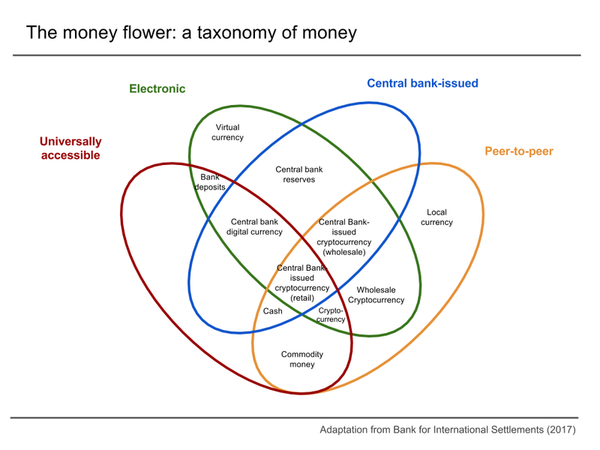

Digital money can either be centralized, where there is a central point of control over the money supply, or decentralized, where the control over the money supply can come from various sources.

Digital currency types

Digital vs virtual currency

According to the European Central Bank’s “Virtual currency schemes – a further analysis” report of February 2015, virtual currency is a digital representation of value, not issued by a central bank, credit institution or e-money institution, which, in some circumstances, can be used as an alternative to money. In the previous report of October 2012, the virtual currency was defined as a type of unregulated, digital money, which is issued and usually controlled by its developers, and used and accepted among the members of a specific virtual community.

According to the Bank For International Settlements’ “Digital currencies” report of November 2015, digital currency is an asset represented in digital form and having some monetary characteristics. Digital currency can be denominated to a sovereign currency and issued by the issuer responsible to redeem digital money for cash. In that case, digital currency represents electronic money (e-money). Digital currency denominated in its own units of value or with decentralized or automatic issuance will be considered as a virtual currency[3].

As such, bitcoin is a digital currency but also a type of virtual currency. Bitcoin and its alternatives are based on cryptographic algorithms, so these kinds of virtual currencies are also called cryptocurrencies.

Digital vs traditional currency

Most of the traditional money supply is bank money held on computers. This is also considered digital currency. One could argue that our increasingly cashless society means that all currencies are becoming digital (sometimes referred to as “electronic money”), but they are not presented to us as such.

How does digital currency work?

Centralized systems

Many systems—such as PayPal, eCash, WebMoney, Payoneer, CashU, and Ven will sell their electronic currency directly to the end user. Other systems only sell through third party digital currency exchangers. The M-Pesa system is used to transfer money through mobile phones in Africa, India, Afghanistan, and Eastern Europe. Some community currencies, like some local exchange trading systems (LETS) and the Community Exchange System, work with electronic transactions.

Mobile digital wallets

A number of electronic money systems use contactless payment transfer in order to facilitate easy payment and give the payee more confidence in not letting go of their electronic wallet during the transaction.

- In 1994 Mondex and National Westminster Bank provided an ‘electronic purse’ to residents of Swindon

- In about 2005 Telefónica and BBVA Bank launched a payment system in Spain called Mobipay which used simple short message service facilities of feature phones intended for pay-as you go services including taxis and pre-pay phone recharges via a BBVA current bank account debit.

- In Jan 2010, Venmo launched as a mobile payment system through SMS, which transformed into a social app where friends can pay each other for minor expenses like a cup of coffee, rent and paying your share of the restaurant bill when you forget your wallet. It is popular with college students, but has some security issues. It can be linked to your bank account, credit/debit card or have a loaded value to limit the amount of loss in case of a security breach. Credit cards and non-major debit cards incur a 3% processing fee.

- On September 19, 2011, Google Wallet was released in the US only, which makes it easy to carry all your credit/debit cards on your phone.

- In 2012 O2 (Ireland) (owned by Telefónica) launched Easytrip to pay road tolls which were charged to the mobile phone account or prepay credit.

- O2 (United Kingdom) invented O2 Wallet at about the same time. The wallet can be charged with regular bank accounts or cards and discharged by participating retailers using a technique known as ‘money messages’. The service closed in 2014.

- On September 9, 2014 Apple Pay was announced at the iPhone 6 event. In October 2014 it was released as an update to work on iPhone 6 and Apple Watch. It is very similar to Google Wallet, but for Apple devices only.

Decentralized systems

A cryptocurrency is a type of digital token that relies on cryptography for chaining together digital signatures of token transfers, peer-to-peer networking and decentralization. In some cases a proof-of-work scheme is used to create and manage the currency.

Cryptocurrencies allow electronic money systems to be decentralized; systems include:

- Bitcoin, the first cryptocurrency, a peer-to-peer electronic monetary system based on cryptography.

- Ethereum, an open-source, public, blockchain-based distributed computing platform featuring smart contract (scripting) functionality.

- Bitcoin Cash, a 2017 fork of bitcoin; main differences from bitcoin are larger blocks, different difficulty adjustment algorithm, and lack of Segregated Witness.

- IOTA, an open-source distributed ledger and an electronic monetary system designet for the Internet of Things. It uses a directed acyclic graph (DAG) instead of a blockchain.

- Ripple monetary system, a monetary system based on trust networks.

- Litecoin, originally based on the bitcoin protocol, intended to improve upon its alleged inefficiencies. Faster block times and different mining algorithm compared to bitcoin.

- Dash, originally based on the bitcoin protocol, it offers the option of instant and private transactions. It is a Decentralized Autonomous Organization.

- Hatch, a 2018 fork of Dash.

- NEM, a peer-to-peer electronic monetary system and a blockchain platform which allows for storing digital assets.

- NEO, an open-source, public, blockchain-based distributed computing platform featuring smart assets contract functionality.

- Monero, an open source cryptocurrency created in April 2014 that focuses on privacy, decentralisation and scalability.

- Zcash, a cryptocurrency that offers privacy and selective transparency of transactions.

- Dogecoin, a Litecoin-derived system meant by its author to reach broader demographics.

- NXT, conceived as flexible platform to build applications and financial services around.

- Zcoin, a privacy centric cryptocurrency that utilized the zerocoin protocol.

Virtual currency

- Main article: Virtual currency

A virtual currency has been defined in 2012 by the European Central Bank as “a type of unregulated, digital money, which is issued and usually controlled by its developers, and used and accepted among the members of a specific virtual community”. The US Department of Treasury in 2013 defined it more tersely as “a medium of exchange that operates like a currency in some environments, but does not have all the attributes of real currency”. The key attribute a virtual currency does not have according to these definitions, is the status as legal tender.

Law and Regulation of electronic money

Since 2001, the European Union has implemented the E-Money Directive “on the taking up, pursuit and prudential supervision of the business of electronic money institutions” last amended in 2009. Doubts on the real nature of EU electronic money have arisen, since calls have been made in connection with the 2007 EU Payment Services Directive in favor of merging payment institutions and electronic money institutions. Such a merger could mean that electronic money is of the same nature as bank money or scriptural money.

In the United States, electronic money is governed by Article 4A of the Uniform Commercial Code for wholesale transactions and the Electronic Fund Transfer Act for consumer transactions. Provider’s responsibility and consumer’s liability are regulated under Regulation E.

Regulation

Virtual currencies pose challenges for central banks, financial regulators, departments or ministries of finance, as well as fiscal authorities and statistical authorities.

US Treasury guidance

On 20 March 2013, the Financial Crimes Enforcement Network issued a guidance to clarify how the US Bank Secrecy Act applied to persons creating, exchanging and transmitting virtual currencies.

Securities and Exchange Commission guidance

In May 2014 the U.S. Securities and Exchange Commission (SEC) “warned about the hazards of bitcoin and other virtual currencies”.

New York state regulation

In July 2014, the New York State Department of Financial Services proposed the most comprehensive regulation of virtual currencies to date, commonly called BitLicense. Unlike the US federal regulators it has gathered input from bitcoin supporters and the financial industry through public hearings and a comment period until 21 October 2014 to customize the rules. The proposal per NY DFS press release “… sought to strike an appropriate balance that helps protect consumers and root out illegal activity”. It has been criticized by smaller companies to favor established institutions, and Chinese bitcoin exchanges have complained that the rules are “overly broad in its application outside the United States[4]“.

Adoption by governments

As of 2016, over 24 countries are investing in distributed ledger technologies (DLT) with $1.4bn in investments. In addition, over 90 central banks are engaged in DLT discussions, including implications of a central bank issued digital currency.

- Hong Kong’s Octopus card system: Launched in 1997 as an electronic purse for public transportation, is the most successful and mature implementation of contactless smart cards used for mass transit payments. After only 5 years, 25 percent of Octopus card transactions are unrelated to transit, and accepted by more than 160 merchants.

- London Transport’s Oyster card system: Oyster is a plastic smartcard which can hold pay as you go credit, Travelcards and Bus & Tram season tickets. You can use an Oyster card to travel on bus, Tube, tram, DLR, London Overground and most National Rail services in London.

- Japan’s FeliCa: A contactless RFID smart card, used in a variety of ways such as in ticketing systems for public transportation, e-money, and residence door keys.

- Netherlands’ Chipknip: As an electronic cash system used in the Netherlands, all ATM cards issued by the Dutch banks had value that could be loaded via Chipknip loading stations. For people without a bank, pre-paid Chipknip cards could be purchased at various locations in the Netherlands. As of January 1, 2015, you can no longer pay with Chipknip.

- Belgium’s Proton: An electronic purse application for debit cards in Belgium. Introduced in February 1995, as a means to replace cash for small transactions. The system was retired in December 31, 2014.

- Canada

The Bank of Canada have explored the possibility of creating a version of its currency on the blockchain.

The Bank of Canada teamed up with the nation’s five largest banks — and the blockchain consulting firm R3 — for what was known as Project Jasper. In a simulation run in 2016, the central bank issued CAD-Coins onto a blockchain similar Ethereum. The banks used the CAD-Coins to exchange money the way they do at the end of each day to settle their master accounts.

- Denmark

The Danish government proposed getting rid of the obligation for selected retailers to accept payment in cash, moving the country closer to a “cashless” economy. The Danish Chamber of Commerce is backing the move. Nearly a third of the Danish population uses MobilePay, a smartphone application for transferring money. In December 2015, Sistema de Dinero Electrónico (“electronic money system”) was launched, making Ecuador the first country with a state-run electronic payment system.

- Germany

The Deutsche German central bank is testing a functional prototype for the blockchain technology-based settlement of securities and transfer of centrally-issued digital coins.

- Netherlands

The De Nederlandsche Dutch central bank is experimenting with a bitcoin-based virtual currency called “DNBCoin”.

- Russia

Government-controlled Sberbank of Russia owns Yandex.Money – electronic payment service and digital currency of the same name.

- South Korea

South Korea plans national digital currency using a Blockchain. The chairman of South Korea’s Financial Services Commission (FSC), Yim Jong-yong, announced that his department will “Lay the systemic groundwork for the spread of digital currency.”

- Sweden

Sweden is in the process of replacing all of its physical banknotes, and most of its coins by mid 2017. However the new banknotes and coins of the Swedish krona will probably be circulating at about half the 2007 peak of 12,494 kronor per capita. The Riksbank is planning to begin discussions of an electronic currency issued by the central bank to which “is not to replace cash, but to act as complement to it.” Deputy Governor Cecilia Skingsley states that cash will continue to spiral out of use in Sweden, and while it is currently fairly easy to get cash in Sweden, it is often very difficult to deposit it into bank accounts, especially in rural areas. No decision has been currently made about the decision to create “e-krona”. In her speech Skingsley states: “The first question is whether e-krona should be booked in accounts or whether the ekrona should be some form of digitally transferable unit that does not need an underlying account structure, roughly like cash.” Skingsley also states that: “Another important question is whether the Riksbank should issue e-krona directly to the general public or go via the banks, as we do now with banknotes and coins.” Other questions will be addressed like interest rates, should they be positive, negative, or zero?

- Switzerland

In 2016, a city government first accepted digital currency in payment of city fees. Zug, Switzerland added bitcoin as a means of paying small amounts, up to , in a test and an attempt to advance Zug as a region that is advancing future technologies. In order to reduce risk, Zug immediately converts any bitcoin received into the Swiss currency.

Swiss Federal Railways, government-owned railway company of Switzerland, sells bitcoins at its ticket machines.

The chief economist of Bank of England, the central bank of the United Kingdom, proposed abolition of paper currency. The Bank has also taken an interest in bitcoin. In 2016 it has embarked on a multi-year research programme to explore the implications of a central bank issued digital currency. The regulator also announced that blockchain could be a part of a national project called “Cashless Economy”. There are concerns that cryptocurrencies are extremely risky due to their very high volatility and potential for pump and dump schemes. Regulators in several countries have warned against their use and some have taken concrete regulatory measures to dissuade users. The non-cryptocurrencies are all centralized. As such, they may be shut down or seized by a government at any time. The more anonymous a currency is, the more attractive it is to criminals, regardless of the intentions of its creators. Bitcoin has also been criticised for its energy inefficient SHA-256-based proof-of-work.

External links

See Also on BitcoinWiki

- Digital wallet

- Cryptocurrency wallet

- Electronic Money Association

- Cryptocurrency

- Ethereum Classic

- Mining