HubrisOne

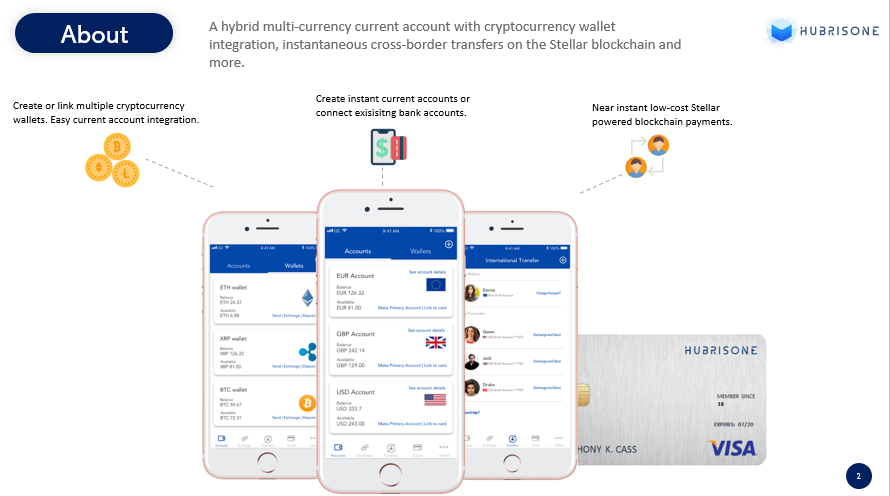

HubrisOne is a cryptocurrency wallet and traditional fiat bank account combined into a powerful, intelligent, regulated and compliant digital mobile application. HubrisOne is focused on merging the benefits of these two powerful industries, seamlessly.

HubrisOne has been designed to be easy to use, secure and intelligent. HubrisOne is more than just a digital cryptocurrency friendly bank account. It is a realistic and innovative approach to banking and cryptocurrency utilization together.

Contents

HubrisOne Vision

HubrisOne’s vision is to bring the benefits of traditional world of finance and banking and the new world of cryptocurrencies together in a new, secure, regulated and user-friendly way.

There is a need for a regulated, trusted and licensed go to solution that will help new investors to adopt into the cryptocurrency market, whilst still maintaining the importance of their trusted banking system they use on a daily basis. HubrisOne knows that current banking system has plenty of improvement points. HubrisOne might improve their current processes and services on offer by leveraging the technology such as blockchain and cryptocurrencies.

HubrisOne aims to become the world’s first cryptocurrency friendly digital bank, fully complaint and regulated within the United Kingdom.

The Problem

Challenges Caused by the Infancy of Cryptocurrency Market

Due to its infancy the cryptocurrency market is facing many significant issues, including but not limited to;

- The lack of global financial inclusion (CGAP, 2018)

- Lack of a full end-to-end, on ramp and off ramp platform for new investors into the cryptocurrency market.

- Unregulated services and solutions such as exchanges, derivatives and indexes and other investment derivative investment linked products (TechCrunch, 2018)

- Price volatility and manipulation (CNN, 2018)

- Lack of trust, transparency and Fraud (HBR, 2018)

Viewing Cryptocurrency Differently From Fiat Currencies

Most of the people in traditional finance space believe that cryptocurrencies will not be around in the future. On the contrary, most of the cryptocurrency enthusiasts believe the opposite. HubrisOne sees the market evolving and developing to find a fair-balanced middle ground between the two form of currencies as noted above. Therefore, it is most probable that cryptocurrencies and fiat currencies in the future will operate as one overarching option of global currency, with each having their own use case. If cryptocurrencies are to be taken seriously by the world and for mass adoption to be achieved, HubrisOne needs to legitimise cryptocurrencies through a trustworthy, secure and regulated medium, channel or solution.

Recognising the Role of the Banking System

Most of the cryptocurrency enthusiasts are against the banking system with a subjective approach. An objective and realistic analysis of to the existing banking systems reveals the fact that it plays important roles in peoples lives. Global banking system has been established, built and trusted for over 200 years. This 200-year old banking industry has its pitfalls, however, it is important to emphasise its significance, access and opportunities it has given (BBA):

- secure payment networks that keep the world’s economy moving 24/7

- Providing financing and access for people to buy their dream homes, cars or holidays

- Allows billions of people each day to pay for goods and services on and offline

- Has provided millions of jobs globally

- Pays millions of salaries everyday

- Moves billions of payments everyday globally

The Cryptocurrency World Needs a Bank

Recently, the world and the cryptocurrency community has witnessed a severe backlash from traditional banks, payments processors and credit card companies banning customers and users from buying, investing or transacting in any cryptocurrency related businesses (Forbes, 2018).

Complacency & Poor Customer Service

Only 23 percent of customers globally believe their bank is meeting their expectations, according to a newly released survey of 9,000 bank customers in nine countries by FIS, a banking and payments technology company (FIS, 2015). Banks globally are failing to meet their customer’s expectations; however, customers do not have or know of any alternatives they can switch to due to the monopolistic nature and copy-cat offerings each bank presents. Below are a few issues and examples banks place on to their valued customers, not limited to the following:

- Old fashioned and outdated verification systems – up to 20-minute wait times

- Lack of new and innovative communication channels – no live chat

- Slow and outdated payment systems

- No payments processed on the weekend

- Unnecessary fees for overdrafts and missed payments

- Long wait times for a new card or pin number

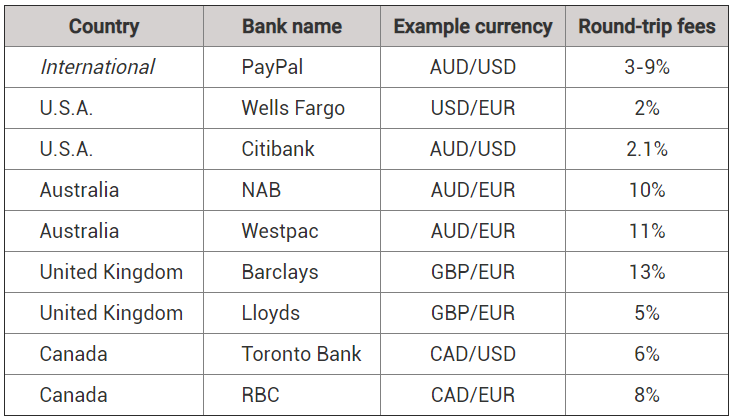

The Banks: Extortionate Global Exchange Fees

When you are sending money to a different location and you transfer money the banks can charge you up to the purchase is in a different currency, the banks can charge you up to 13% on each transfer. The greedy and unfair part is they could give you the inter-bank FX rates whereby your fees are reduced by up to 98% to 100%. Here’s an excerpt taken from (TD, 2018)– which captures the above problem perfectly. “So let’s say you are moving countries and you sold your house in one country and bought in another. $200,000 house, transferring from London to New York, or from Sydney to San Francisco. How much do you pay the bank when you wire the money? You might be shocked to discover that the fees are as high as 13%.

That’s on a round-trip exchange, meaning if you changed the money then changed it back you would lose 13%. Of course you’re not going do a round trip exchange, but it gives you the idea of how much the banks are making. The average fees are around 7% round-trip or 3.5% one way. This means that on your $200,000 house you just paid $7,000 to the bank to transfer the money for you.”

Below you will find a table that displays the add-on fees banks commission on each of your transfers you make.

[[]]

Additionally, to the above HubrisOne finds the following issues are very prevalent and need to be disrupted: HubrisOne’s research and market analysis suggests the majority of people are unhappy and are unsatisfied with their bank for various reasons, ranging from, but not limited to:

- Fees being too high

- Lack of quality customer service

- Significant inefficiency

- Lack of innovation

- Greed and not being customer-centric

High Competition in Customer Acquisition

Acquiring and retaining profitable customers is an ever-growing challenge for banks. It is apparent that customer demographics, buying behaviour and needs are evolving rapidly, and have accelerated even more with the introduction of cryptocurrencies.

The competition is aggressive and adapting rapidly. Traditional banks now need a 360-degree view of each customer in order to focus their resources efficiently (BoC, 2017).

Solutions & Value Propositions

Instant Digital Bank Accounts

HubrisOne has made it extremely easy and simple to create a bank account in GBP, USD and EUR dominated currencies. This means, upon approval of KYC and AML, users will be able to transact, transfer and store funds as they would in their bank account today. For free. Allowing users to create unlimited personal IBAN, BIC, and UK sort code and account numbers in seconds, creates an eco-system of personal accounts for savings, college funds, rainy day fund or holiday savings. Users can securely pay in your salary, set up recurring payments or pay bills and merchants.

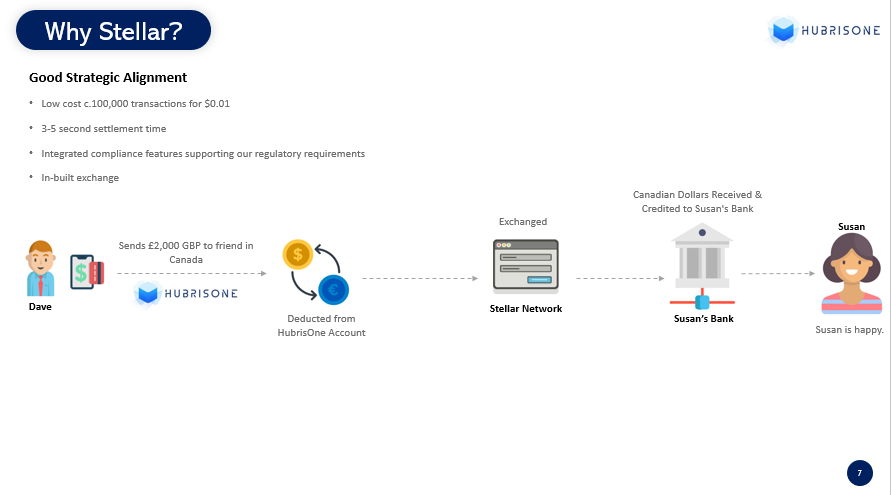

International Transfers using Stellar Blockchain

There is no need to wait 3-5 days for intentional payments to arrive, and no need to pay extortionate exchange fees. HubrisOne has made it extremely easy for users to transfer funds from their HubrisOne bank account using secure blockchain payments, this brings many benefits never seen before in the banking industry, such as:

- Real-time traceability and tracking of funds, you’ll know when and where your transfer is at all times

- International payments using the Stellar blockchain Connectivity across international banking payments networks

- An instant on-demand settlement, when you transfer with faster payments or SEPA (usually within 2-4 hours)

A key feature of the HubrisOne app will be the ability to conduct traditional and blockchain international payments. Users will be given the option of transferring funds to bank accounts via SEPA, SWIFT or Faster Payments or send via Stellars’ international blockchain payment technology.

Why Stellar?

- Quick settlement. 3-5 seconds for a token holder to send the token to someone else.

- Cheap transactions

- Built in exchange with any other token, asset or currency in the network.

- Stellar is scalable – Stellar transaction is 1/100,000 of a penny. In recent tests, Stellar has achieved 10,000 transactions per second and with an average settlement time of 5 seconds.

- Ability to do voting, dividends or awards all in the same network.

- Stellar supports eco-system expansion

This means that HubrisOne will be a cross-chain cryptocurrency asset operating on two blockchains.

- ERC20 Ethereum for HubrisOne ICO and as a utility to gain access to HubrisOne features and

- Stellars’ blockchain for international instantaneous payments.

Secure Cryptocurrency Wallets

Cryptocurrency wallets provided by HubrisOne will enable users to exchange, convert and transact fiat to and from cryptocurrency working in perfect harmony with the HubrisOne bank accounts and HubrisOne debit cards. . Features offered:

- Storing and accessing cryptocurrency funds directly from the HubrisOne app.

- Users will have full ownership of their keys.

- Freedom, variety and diversify add up to 200 cryptocurrencies and selected alt-coins.

- Easily transfer between cryptocurrency wallets and HubrisOne bank account, and spend globally using the HubrisOne secure debit card.

- Sending cryptocurrency to friends, family or to an exchange within a few taps.

Secure Digital Account and Card Management

As digital ownership grows, banking will be the next industry to be disrupted digitally. HubrisOne will transform the old-fashioned long waiting times on the phone into digital self-account management. Users will be able to do everything they can do with a bank representative over the phone with HubrisOne, which means they will be in charge on their accounts and cards whenever they want 24/7.

Features offered:

- Create a new virtual card for online purchases in a few taps. Order a physical card directly from your app. No phone calls, no call centres.

- Change, view or reset your security pin in two seconds. No need to order a pin by mail.

- Link your card to your HubrisOne bank account or to your cryptocurrency wallet. One card, multiple accounts.

Fair and Transparent Crypto-Backed Loans

Users will be able to receive fiat payments upon approval of their application in under 5 seconds in to their HubrisOne connected bank account.

People might need a loan from their bank but their credit score is poor, a situation million’s face daily. However, as cryptocurrency adoption grows, and ownership of cryptocurrencies grow along with it we will begin to increase demand for financing services which are linked to the ownership value of their cryptocurrencies.

Features offered:

- Instant crypto-back lending financing

- Transfer fund instantly to your HubrisOne bank account.

- Instant decision in 2 seconds

- No credit score check required

- Flat 10% interest rate

Real-time Transaction Monitoring

HubrisOne is leveraging it’s technology to bring it’s users a new and refreshed way to report their transactions, they no longer need to wait monthly for their statements. HubrisOne enables users to know how much they have spent in FIAT and cryptocurrency live rates and more

Features offered:

- Generate PDF statements in a touch of button. Automated monthly account analysis, keep on top of your spending habits.

- See the location, vendor and amount spent. View the amount in real-time in fiat and cryptocurrency rates.

- Selecting primary currency (crypto or fiat), linking or unlinking seamlessly to your HubrisOne card, quickly and easily.

- Automated risk and fraud alerts

Hubris Wealth Management Solutions

HubrisOne allows users to consolidate their new and existing portfolios under one roof whilst maintaining their fund management company. HubrisOne is simplifying wealth management solutions for our users by incorporating data powered insights and analytics, a vast breadth of investment finance products, from cryptocurrency indexes to traditional S&P global index and more.

Features provided:

- Withdraw or add funds directly from your HubrisOne bank account in seconds.

- Access third-party funds and wealth managers using the Hubris Token.

Integrated Cryptocurrency Exchange

- Users will be able to use ‘auto exchange’ function to exchange between your bank account and cryptocurrency wallets, instantly. Fees from only 0.60%.

- Easy to use, user-friendly and instant. Stabilise your exposure to cryptocurrencies by quickly exchanging to fiat.

- Up to 200 cryptocurrencies and selected alt-coins will be available upon launch.

Third Party Open Marketplace

We’re introducing the HubrisOne open partner marketplace to connect our users to other blockchain and non-blockchain service providers and to increase and improve our scope of service offerings. Connecting great services and solutions to willing customers, users and investors.

Think about a comparison website when you are traveling or when booking a hotel. This is a similar structure and concept that would be applied. These additional services can and only will be available to Hubris Token holders.

Secure Contactless Debit Card

Multiple accounts, one card. Within a few taps you can connect your debit card to your bank account, cryptocurrency wallet or set your account to auto-spend from a nominated account. We’ve simplified each step and made it seamless to connect users to the world of cryptocurrency and the traditional world of banking.

Users cards come fully loaded as you would expect from your bank plus more:

- Contactless payments

- Spend where the VISA logo is accepted

- Secure with 24/7 account monitoring

The Growth of Smartphone Usage and Unbanked

The growth of smartphone usage aligns with our growth plans and direction of developing an app only digital banking solution which is lightweight, secure and accessible. In saying this, there are over 2 billion unbanked adults who do not have access to the banking infrastructure that we take we granted.

According to Statista, the number of smartphone users is forecast to grow from 2.1 billion in 2016 to around 2.5 billion in 2019, with smartphone penetration rates increasing we see a general global shift to mobile-only digital solutions and banking is an area that is due for a digital shake-up (Statista, 2016).

Helping Cryptocurrency Adoption

The HubrisOne app will increase the adoption rate through our cryptocurrency integrated digital banking accounts.

By presenting a familiar banking solution with cryptocurrency integration, we will slowly increase adoption and gain users at the same time

By enabling our target market to execute their day to day banking operations from the HubrisOne app and providing easy access to the cryptocurrency market infrastructure, we provide a simple vessel for users to adopt cryptocurrencies exponentially.

Security & Ownership

HubrisOne will integrate and implement the strictest security features to ensure consistent trust, integrity and reliability of the app.

Features provided:

- PCI-DSS Compliant

- 24/7 Real-time anti-fraud machine learning account monitoring

- Integrated digital and instant AML & KYC verification

- Application is run entirely over encrypted SSL

- Two-factor authentication for additional security

- Wallets and private keys are yours and are stored in AES-256 encryption

Business Model

The Market Opportunity: How Big is the Global Market?

The market for the HubrisOne app and digital banking solution is vast and an extremely attractive market. Firstly, we are offering a digital banking solution to people who meet the following criteria:

- Have a smartphone with internet connection with access to Apple App Store or Google Play

- Have or need a bank account.

- Over 18

Note: The above criteria has been simplified for illustration purposes, but already, the evidence is apparent that our solution is a mass market product and applies to the mass population, which already shows the potential demand of the market we are targeting. According to the WSBI, over 37 million individuals do not have a bank account within the EU. The EU will be the first regional hub HubrisOne will launch (WSBI). On the contrary, over 430 million individuals have a bank account within the EU. The above two criteria are our target market we will focus on upon launch of HubrisOne. A combined 467 million target opportunity in the EU alone. Additionally, we have identified over 2 billion global unbanked adults which will be our secondary target market. HubrisOne appeals to the mass market, however we have further segmented this market in order for our focus to not be too wide. Hence our proposition is cryptocurrency-banking, cryptocurrency first and compliant and regulated banking solutions second.

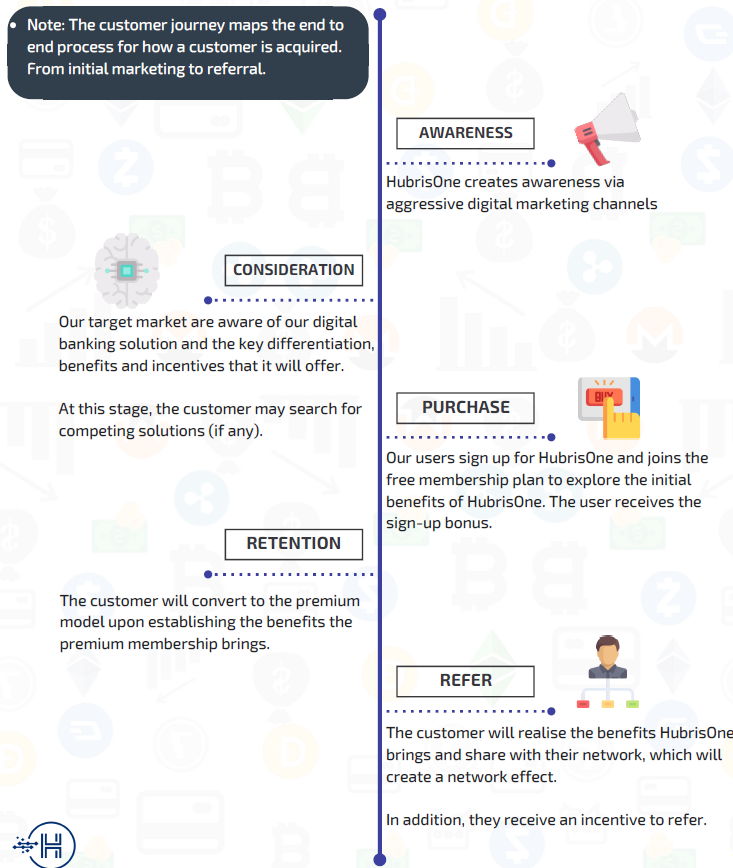

Customer Acquisition Strategy

We will implement three key customer acquisition models which will generate revenue to cover costs, increase cryptocurrency adoption and increase the rate of customer acquisition.

Our customer acquisition model is a simple yet effective strategy. Many of our future users and customers will be acquired through the following three key acquisition strategies. We ensured that the cost to acquire was significantly lower than the future revenue and monetization potential each customer would bring.

We will be focusing and are implementing three strategic customer acquisition channels:

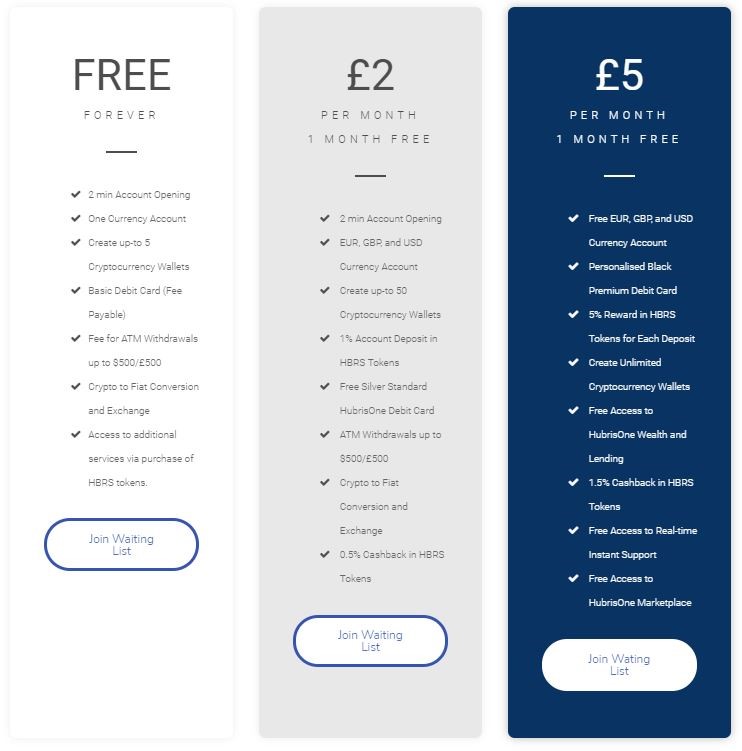

Freemium Model

HubrisOne will offer basic digital current accounts services for free in addition to other services. However, a fee will be charged per month for additional premium services.

By giving away the basic product for free it is easier to attract users and create a strong customer base. Some key benefits we see are: Customer acquisition, marketing effect via word of mouth and network effect, the more people that use HubrisOne the more people it will attract.

Hubris Token Reward for User Sign up

The second key strategic acquisition channel we see as being effective and significant is leveraging the native HubrisOne cryptocurrency tokens (HBRS) which will be used as a reward (among other uses) for each customer that signs up with HubrisOne.

By rewarding users to sign up with our Hubris Token, we incentivise and reward new users to join and share. This will increase the rate of our customer acquisition, and significantly increase the growth rate of our customer base via organic network and marketing effect.

Partnerships & Third Party Open Platform

The third key strategic acquisition channel we see as being effective and significant is creating and building an open platform for third-party blockchain and non-blockchain services.

Creating an open platform for non-conflicting third-party services and solutions we:

- create a revenue stream via commissions and on-boarding fee.

- we create awareness of blockchain services thereby increasing adoption

- we increase the scope of services we provide indirectly without increasing the cost of having to offer these services directly. Partnerships will be key and we are in discussions with key players in financial services, insurance, and retail.

Competition & Differentiation

We are aware of competing solutions which offer similar or fragmented digital banking solutions. However, we are yet to identify a solution which offers the same offerings as HubrisOne. Upon analysis we find the market is in it’s infancy and our value propositions have been tailored to our primary customer segment.

Below you will find three potential competitors, now and in the future:

- Wirex

- Revolut

- TenX

Note: There may be smaller competitors, however we have not identified them as serious contenders for the cryptocurrency and digital banking market. These smaller competitors have been identified as: MinexPay, ViaBuy

Although we have identified there are competitors, we have mapped out the market ad understand that our solution differentiates significantly.

Revenue Generation & Sustainability

Revenue Generation Split

The chart below visually displays whether the majority of our revenue generation streams will derive from, this is subject to change as we launch and test the market with different marketing and customer acquisition strategies.

Membership Fees

We estimate and predict that the majority (~70%) of our revenues will be generated from monthly membership fees which will be billed in the user’s nominated currency. It is important for HubrisOne to capture market share early on, and convert users over to the paid premium membership.

Crypto-Backed Lending

20% of revenues will derive from cryptocurrency backed loans and financing which will be available directly from the app. We aim to apply a 10% APR flat interest rate on any applications made through the app. Once again volumes will be very important for the company to grow and increase revenues.

Open Partner Marketplace

We anticipate generating the least revenue from our open partner marketplace, however, this was stablished upon developing this value proposition. We expect this solution to add value to our customers, increase the scope of services that we offer without the added costs and partner with some of the world’s largest corporates.

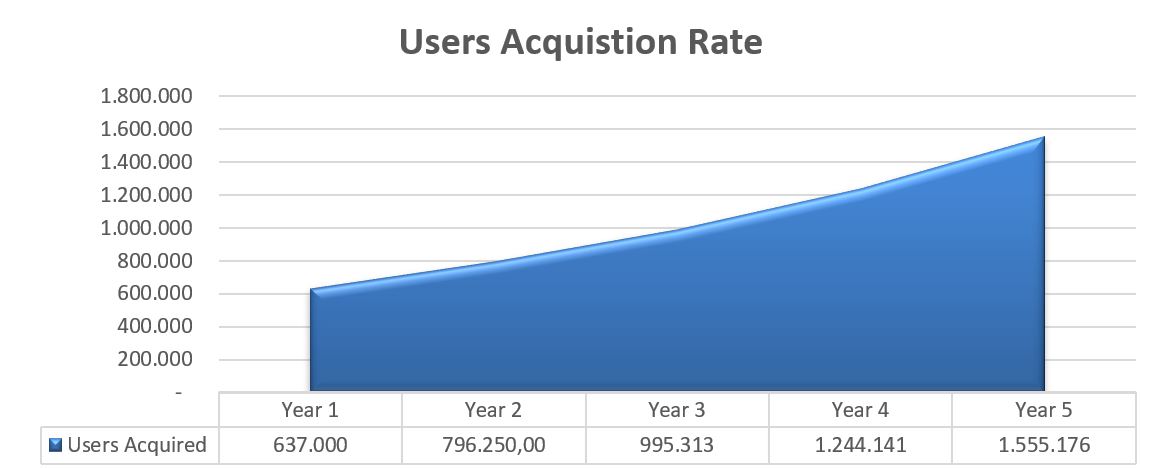

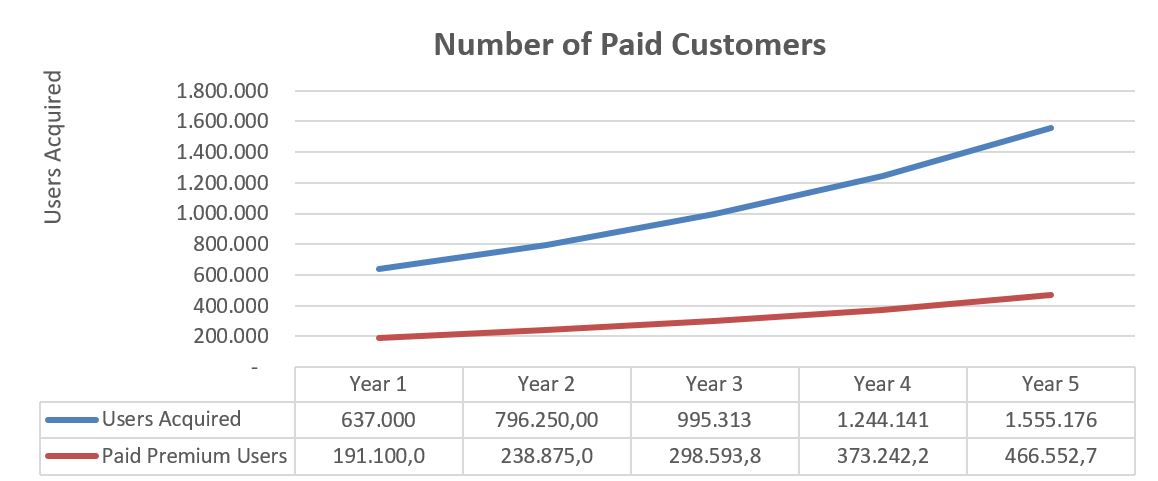

Customer Acquisition Analysis: Years 1-5

Below you will find details and data points regarding our customer acquisition within the first five years of operation. We have based these predictions on real, tangible, relevant data points. We have used Revolut’s growth rate in the past two years as a base standard. Revolut in some respect can be identified as a potential competitor of HubrisOne.

The data below has been adjusted to reflect the following:

- The infancy of HubrisOne

- Lack of brand awareness of HubrisOne

- Proof of concept only and no working product

- New cryptocurrency solution and a relatively new market

According to (CNBC, 2017), Revolut was signing up and acquiring over 3,500 users every single day. As mentioned above we will not use the same growth and acquisition rate due to the reasons mentioned earlier. We will apply a 50% reduction in customer acquisition growth. See below for our estimates, analysis and predictions for HubrisOne.

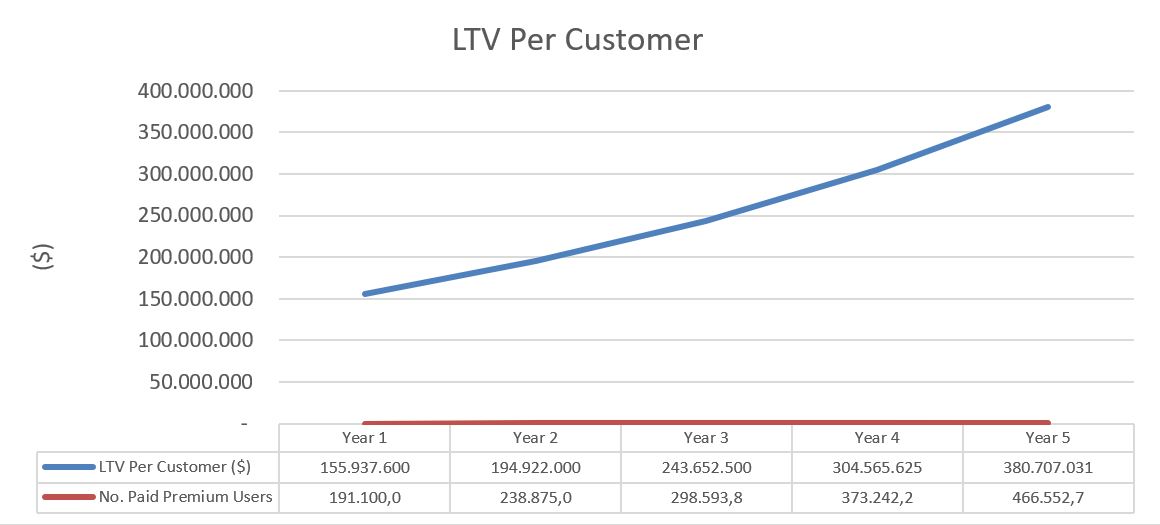

Customer Lifetime Value

Our customer lifetime value, is a simple equation – (current revenue – cost to acquire, projected over the customer lifecycle). However, it is very difficult to measure in today’s changing and always evolving business context. We’ve simplified the above formula to apply to the estimated customer acquisition, number of paid users over a predicted 17 years LTV (life time value cycle).

A new study suggests that the average time a customer remains with a bank is 17 years (Gaurdian, 2013). We will use this as our foundation to generate a customer lifetime value based on 30% of our acquired customers being premium paid users.

Upon launch and through the development of HubrisOne we will establish the perfect monthly fee to charge users per month for our services. The above is only analysis to illustrate the potential of our targeted market over a five-year period without factoring in growth, inflation and others.

As the chart displays above it is important to acquire users, as the more we acquire the higher the growth opportunity and LTV becomes for HubrisOne.

HubrisOne Membership Breakdown

For the purposes of this descriptive whitepaper we have decided to focus solely on membership fees which will form the backbone of our revenue and sustainability model.

See below for our proposed membership model. Free and Premium, with each having their target customers and benefits.

Marketing Channels

HubrisOne has identified it’s user base and customer segment to be digital natives, so it only makes sense for the company to focus heavily on digital marketing channels. As a full digital banking alternative the companies focus is to use analytical tools to effectively target and acquire customers. HubrisOne’s digital marketing campaigns will be the building blocks or actions within customer’s strategy that move them toward their short-term and long-term goals.

We will focus on social media and digital marketing channels, with zero print or television media. The following channels is where we will be focusing our efforts:

- Google Adwords

- Instagram Influencers

- Twitter Ads

- Youtube Ads

- Instagram Ads

- Facebook Ads

- Quora Ads

We have divided our strategy by deeply segmenting our target customer by the following criteria: Quantitative (or Demographic) Information

- Location

- Age

- Income

- Job Title

We will utilise the following three forms of media in conjunction with above social media channels mentioned, HubSpot has provided a short summary on what each type of media provides.

Owned Media This refers to the digital assets that your brand or company owns — whether that’s your website, social media profiles, blog content, or imagery, owned channels are the things your business has complete control over.

Earned Media Quite simply, earned media refers to the exposure you’ve earned through word-of-mouth. Whether that’s content you’ve distributed on other websites (e.g., guest posts), PR work you’ve been doing, or the customer experience you’ve delivered, earned media is the recognition you receive as a result.

Paid Media Paid media is a bit self-explanatory in what its name suggests — and refers to any vehicle or channel that you spend money on to catch the attention of customer’s buyer personas. Marketing will be extremely significant for HubrisOne and as a result the team has dedicated over 20% of funding to marketing alone.

HubrisOne Customer Journey

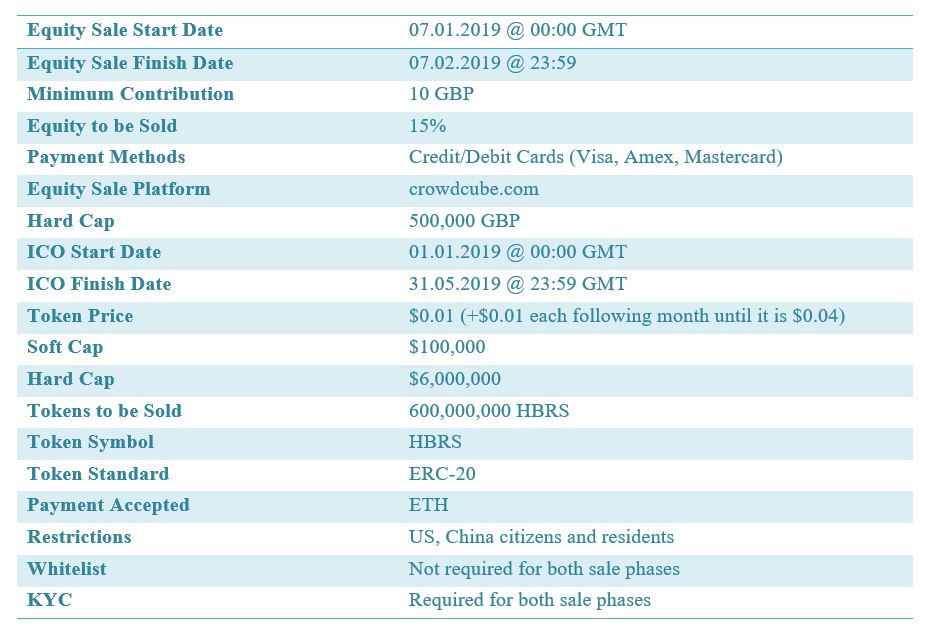

Equity Sale / Token Sale

HubrisOne Utility Token (HBRS)

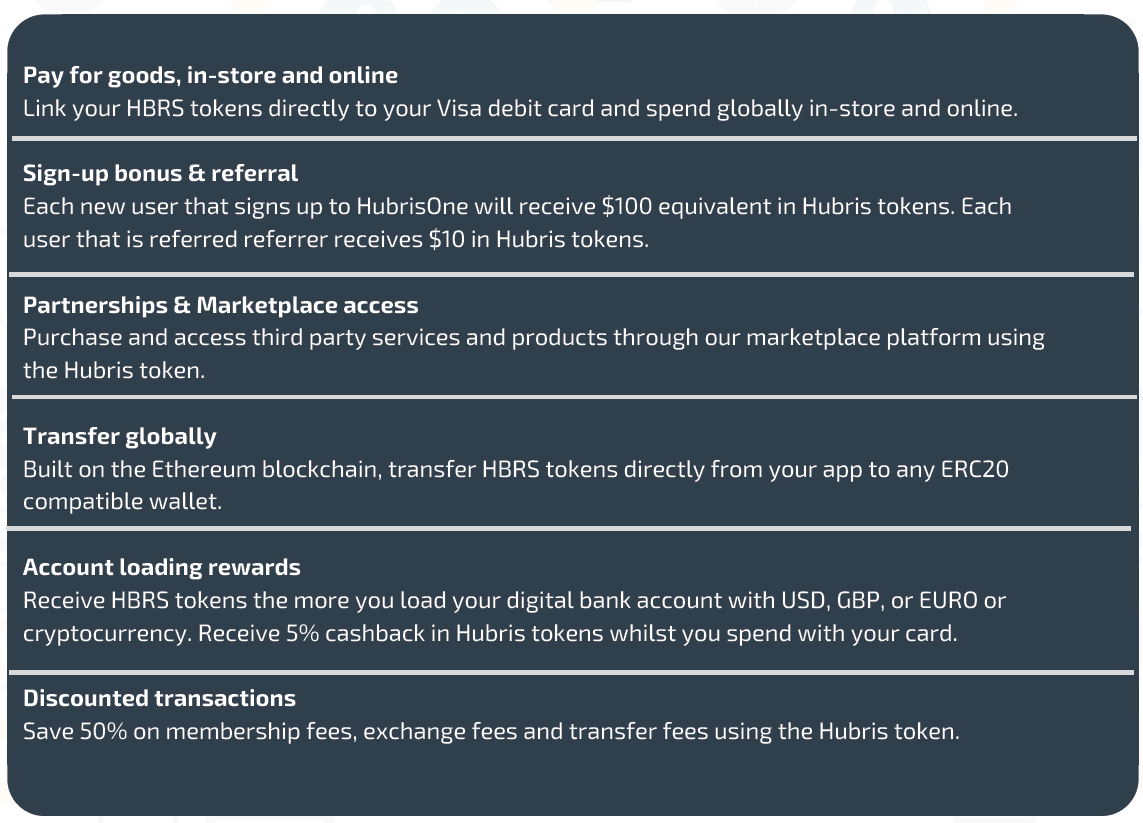

The HBRS token will be the bloodline of the Hubris Application. If the Hubris App is the road, the HBRS token is the cars, trucks and the motorcycles. They are both very dependent on each other.

The HBRS token will be a functional utility token within the platform, this will allow users, investors and our customers to access the following, the list is not exhaustive and further functionalities may be added in due course:

Funding Proceeds: Distribution

Development (40%) Research and continuous development, processing, design and testing expenses for the HubrisOne app. We will contract and, in some cases, hire onto the HubrisOne team the best and experienced developers within the fintech industry

Operations (20%) The operational costs are, in most cases, fixed costs associated with most businesses, this includes office expenses, global contact agents to service the bank accounts 24/7, salaries for the HubrisOne employees and team, exhibition expenses for promotion, travel, human resources expenses and subscriptions for SaaS solutions for day to day running of HubrisOne.

Marketing (20%) We will implement an aggressive social media strategy, due to the mass appeal of our product we have allocated 20% of proceeds to acquire new users. We will primarily execute online social media and platform ads in order to efficiently track ROI.

Security Infrastructure (15%) Due to the sensitivity of our digital banking solution, we will need to implement the strictest security and compliance standards. Therefore, we will recruit experienced compliance, security and regulatory specialists on-board the team. The team at HubrisOne understands the importance of creating a secure trusted alternative digital banking solution.

Partnerships (5%) Partnerships will be key to our business model, and as a result, we will create a headcount (recruit) of two business development and partnerships managers to ensure we partner with the best blockchain and non-blockchain service providers to join our Open Partner Platform.

Roadmap

24/7 Below is our proposed roadmap detailed with key milestones we will achieve during Below is our proposed roadmap detailed with key milestones we will achieve during and after our funding and beyond.

- Subject to adjustment and change, this will be communicated via www.hubrisone.com or via our Official Telegram channels.*

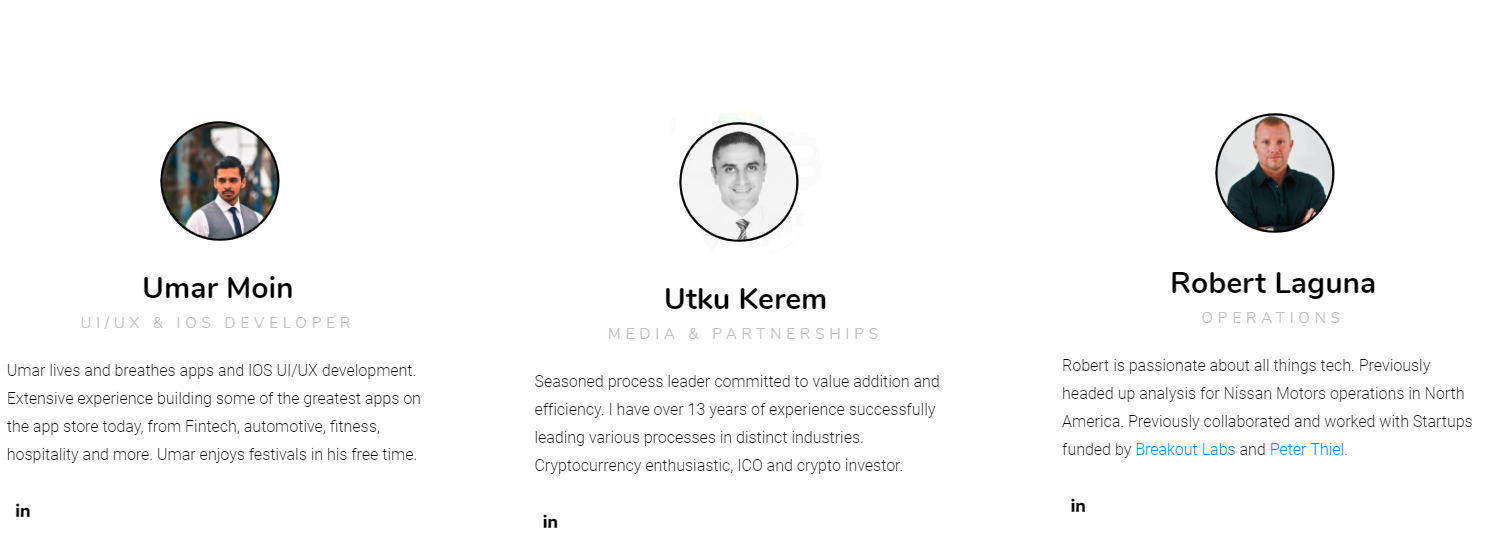

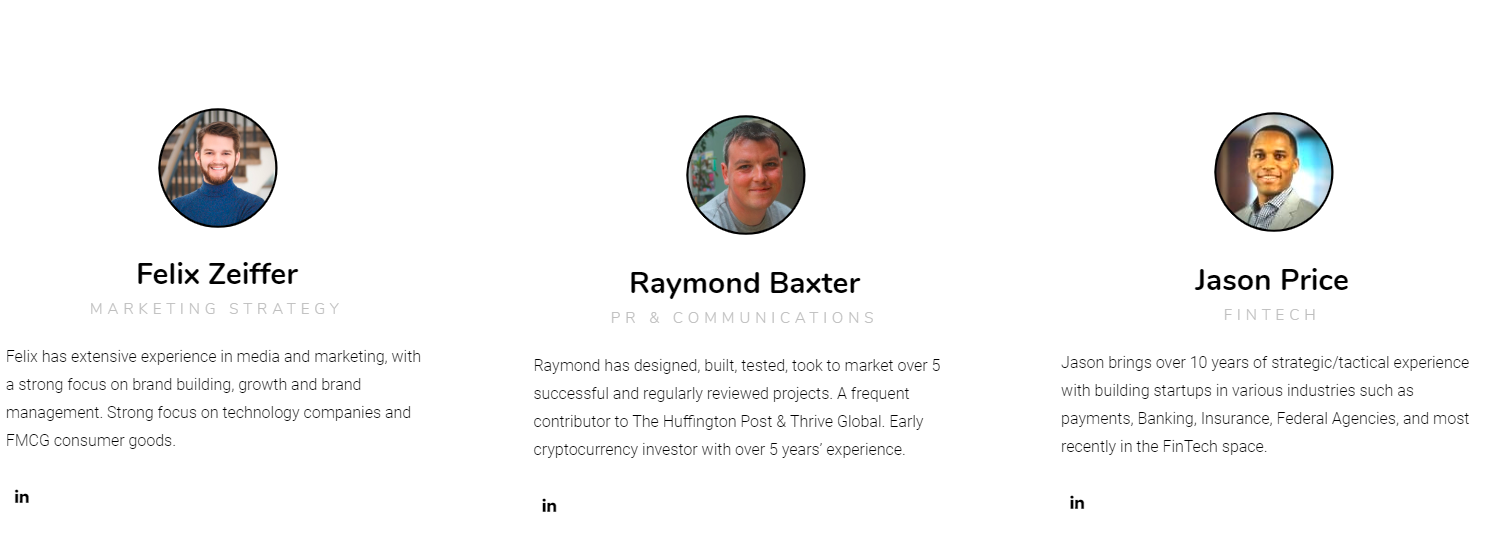

The Team & Advisors

Team

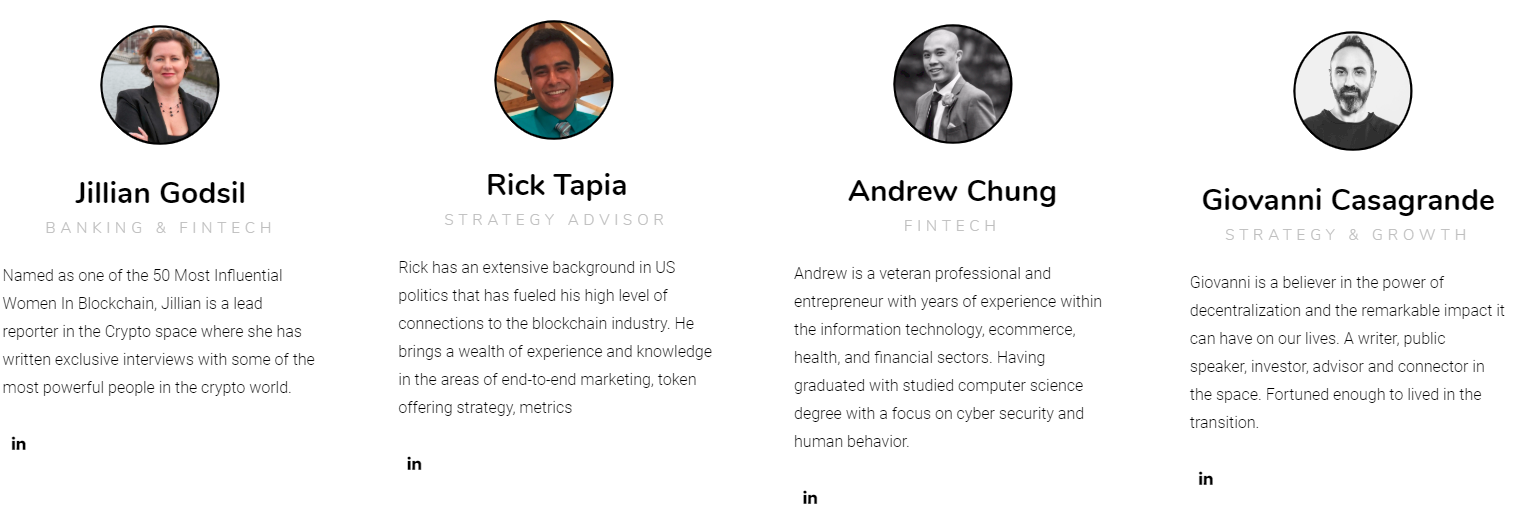

Advisers

Conclusion

Cryptocurrency space does not need fastest blockchains, flawless dApps, shortest settlement times or lowest fees to proceed to the next level. It only needs wider adoption to achieve that. Current phase of cryptocurrency ecosystem is not mature enough to replace traditional systems or processes. It is in its’ infancy.

It is not realistic to expect cryptocurrency to replace fiat currency. On the other hand, cryptocurrencies will not disappear or become idle. In order to achieve wider adoption of cryptocurrencies, we need a solution which, respects and identifies the importance of the traditional banking system and the benefits it provides, however at the same time, removing the greed, unfairness in exchange fees, removing the inefficiencies such as physical branches and call centres – whilst at the same time improving the customer service, product innovation, technology and becoming more customer centric.

Banks have been enabling the tradition to continue globally, letting everyone to have their dream belongings, helping everyone to receive salaries, etc. These are a few significant benefits and real-life examples of what banks provide to the mass population on a daily basis. We recognise the importance of this and at the same time we understand the issues banks have created globally through greed, lack of transparency and complacency.

In order for the market to mature and to increase mass adoption we need to promote freedom and autonomy over people’s own finances. The solution is not to abolish banks, or financial institutions or to overthrow them with the rise of blockchain and cryptocurrencies, but the solution is to merge and marry the benefits from both of these powerful worlds.

We feel there is a strong need for an all-inclusive, end-to-end banking and cryptocurrency solution. Not only will HubrisOne open more doors for cryptocurrency adoption, HubrisOne will allow users and investors to use one solution for all of their banking needs, today and more importantly, in the future. This is banking for the cryptocurrency generation.

It’s about time we move this industry into the future and whilst we’re doing this, HubrisOne is bringing banking into the digital age, and we’ve future-proofed it with the integration of cryptocurrencies and blockchain technology.

The above key pain points is our main focus, including cryptocurrency integration. We see a spectrum wide problem with banking today and this is where we believe the opportunity is. We want to incorporate a customer centric, innovative and trustworthy application that welcomes your feedback.

Disclaimer

Regulatory Compliance & Company Jurisdiction

We are legally registered with companies’ house in the UK company number: 11529615.

Our choice for registration within the United Kingdom was a careful strategic decision which we took after careful consideration, the reasons and rationale for this choice are as follows:

- Firstly, the UK alongside the United States has the most advanced, innovative and established global banking infrastructure in the world.

- Secondly, the UK government is very open-minded with respect to cryptocurrencies and blockchain technologies.

- Thirdly, the United Kingdom has great protectionism over banks, financial institutions which favour the customers, this means our customers funds will be protected under the FCSC scheme (FSCS, 2018).

- Lastly, the United Kingdom along with other EU countries are supporters of digital banking innovation and disruption hence the introduction of the electronic money licence regulation (2011), which we will be leveraging through our card partner upon launch (Europa).

The above decisions were considered, among others, when deciding where to register and create our company. HubrisOne is a trading name of HubrisOne Technologies Ltd.

HubrisOne will be authorized by the Financial Conduct Authority (FCA) through our UK card issuer as an authorized agent, under the e-money institution license. Thereby granting access HubrisOne EEA passporting permissions to all 31 EU countries in the EU. The introduction of the e-money license and the regulation is to allow and spur innovation in a safe and controlled way.

The Electronic money (e-money) is a digital alternative to cash. It allows users to make cashless payments with money stored on a card or a phone, or over the internet. The reasons this license was introduced is primarily for such services such as HubrisOne and many others to flourish and capture market share from traditional banking operators. EU rules on e-money aim to:

- facilitate the emergence of new, innovative and secure e-money services

- provide new companies with access to the e-money market

- encourage effective competition between all market participants

KYC/AML & Compliance

The HBRS tokens on offer during the Crowdsale cannot be re-distributed or resold to citizens or persons who reside or are natural legal citizens of countries where digital currencies, tokens and or digital security tokens are prohibited or restricted by current laws or regulation.

Due to current laws, we are unable to accept investment or participation from the restricted persons (as detailed above) or we reserve the full right to refuse any person(s) from the Crowdsale at our discretion, especially if the information provided to the HubrisOne team is not complete, incorrect, false or unverifiable during the KYC verification process.

Highlighted Risks Disclaimer

As a responsible business and company, we need to highlight potential risks associated with Crowdsale and investments, as with any investment.

Perspective investors that wish to be involved in the Crowdsale and wish to purchase HBRS tokens, must take time to consider the following and evaluate all risks that may be associated with this Crowdsale. Upon purchasing the HBRS tokens, you should carefully evaluate and consider these following areas and assess with your own internal risk assessment criteria.

- Read and assess all the information in this whitepaper

- Cryptocurrency mark volatile price fluctuations

- Inability to be granted licences and regulatory approvals

- Failure to maintain permits, or fail audits

- Failure to deliver by the detailed timeline

- Regulation and compliance risk

- Third-party DDoS attacks and cyber-attacks on the smart contract

- Price volatility once Hubris Tokens is listed on an exchange

HubrisOne stays compliant and allows us to do the following:

- to comply with the requirements of relevant legislation and regulation to help the firm, at the time the due diligence is carried out,

- to be reasonably certain that the customers are who they say they are to provide users with the products or services requested

- to guard against fraud, including impersonation and identity fraud to help HubrisOne to identify, during a continuing relationship

- if unusual events do not have a commercial or otherwise straightforward rationale they may involve money laundering, fraud, or handling criminal or terrorist property

- to enable HubrisOne to assist law enforcement, by providing verifiable available data on customers

Legal Disclaimer

PLEASE READ THESE TOKEN SALE TERMS CAREFULLY. NOTE THAT SECTIONS 14 AND 15 CONTAINS A BINDING ARBITRATION CLAUSE AND REPRESENTATIVE ACTION WAIVER, WHICH AFFECT YOUR LEGAL RIGHTS. IF YOU DO NOT AGREE TO THESE TOKEN SALE TERMS YOU SHALL NOT PURCHASE TOKENS.

YOU ARE NOT ELIGIBLE AND YOU ARE NOT TO PURCHASE TOKENS IF YOU ARE (I) A GREEN CARD HOLDER OF THE UNITED STATES OF AMERICA, OR (II) A CITIZEN OR A RESIDENT (TAX OR OTHERWISE) OF THE UNITED STATES OF AMERICA, PUERTO RICO, THE VIRGIN ISLANDS OF UNITED STATES, OR ANY OTHER POSSESSIONS OF THE UNITED STATES OF AMERICA, OR PEOPLE’S REPUBLIC OF CHINA, OR PERSON OF THAT STATES OR (III) A CITIZEN OR RESIDENT (TAX OR OTHERWISE) OF ANY COUNTRY OR TERRITORY WHERE TRANSACTIONS WITH DIGITAL TOKENS AND/OR DIGITAL CURRENCIES ARE PROHIBITED OR IN ANY OTHER MANNER RESTRICTED BY APPLICABLE LAWS. “PERSON” IS GENERALLY DEFINED AS A NATURAL PERSON RESIDING IN THE RELEVANT STATE OR ANY ENTITY ORGANIZED OR INCORPORATED UNDER THE LAWS OF THE RELEVANT STATE. PURCHASED TOKENS CANNOT BE OFFERED OR DISTRIBUTED AS WELL AS CANNOT BE RESOLD OR OTHERWISE ALIENATED BY THEIR HOLDERS TO MENTIONED PERSONS (“RESTRICTED PERSON”).

This document acts as an agreed upon token sale terms (“Token Sale Terms”, “Terms”) between you (“Purchaser”, “User”, “you”) and HubrisOne Technologies Ltd (Trading name of HubrisOne) company number: 11529615, a United Kingdom company, located in London (“Company”, “us” or “we”). Each of you and Company are a “Party” and collectively the “Parties”. You accept these Terms when you purchase HBRS Tokens (“HBRS”, “HBRS Tokens”, “Tokens”).

HBRS Tokens is a digital product made by the Company for the use by token holders within the HubrisOne app located at https://HubrisOne.com (“Platform”) as a payment for the Platform and Company’s or third parties service fee, which is collected by Company and/or third parties for providing services within the Platform. Any purchase of HBRS Tokens is subject to these Terms. HBRS Tokens are not digital currency, commodity, or any other kind of financial instrument and has not been registered under relevant securities regulations, including the securities laws of any jurisdiction in which you are a resident.

We will provide notice of any amendment to these Terms by posting any revised document to the Website and updating the “Last updated” field above accordingly or by any other method we deem appropriate. We are not obligated to provide notice in any other method beyond these. Any change to these Terms will be effective immediately upon such notice and apply to any ongoing or subsequent purchase of HBRS Tokens.

Information about the Tokens and Tokens sale is set forth in the Whitepaper located at the Website. Purchaser is required to read the Whitepaper and any other documents located at the Website in their entirety prior to purchase of HBRS Tokens.

By purchasing HBRS Tokens from the Company, you will be bound by these Terms and any other terms incorporated by reference as well as with any other document located at the Website. If you have any questions about these Terms, please contact HubrisOne team at [email protected]

All updates related to Crowdsale, legal disclaimer and token agreement will be updated via the website and investors are advised to refer to the website www.hubrisone.com in order to stay up to date as the information in this whitepaper is subject to change.

Full legal disclaimer and token agreement can be found at www.hubrisone.com

References

1. BBA. (n.d.). 2014. Retrieved from https://www.bba.org.uk/news/reports/the-benefits-of-banking/#.W3254c4zapo

2. BoC. (2017). Retrieved from http://www.crm.umontreal.ca/probindustriels2015/pdf/BNC.pdf

3. CGAP. (2018). Bitcoins and Financial Inclusion: Not Much of a Link for Now. Retrieved from http://www.cgap.org/news/bitcoins-and-financial-inclusion-not-much-link-now

4. CNBC. (2017). Digital banking start-up Revolut breaks even as it prepares global expansion. Retrieved from https://www.cnbc.com/2017/11/24/revolut-signs-up-1-million-users-ahead-bitcoin-cryptocurrency-launch.html

5. CNN. (2018). Retrieved from https://www.ccn.com/bitmex-downtime-crypto-pump-manipulation-in-the-bitcoin-market/

6. Europa. (n.d.). Retrieved from https://ec.europa.eu/info/business-economy-euro/banking-and-finance/consumer-finance-and-payments/payment-services/e-money_en

7. FIS, C. (2015). Retrieved from https://www.cnbc.com/2015/05/19/cent-of-customers-happy-with-their-bank-study.html

8. Forbes. (2018). Retrieved from https://www.forbes.com/sites/heatherfarmbrough/2018/02/09/why-britains-largest-bank-stopped-customers-buying-bitcoin-with-credit-cards/

9. FSCS. (2018). Retrieved from https://www.fscs.org.uk/what-we-cover/compensation-limits/deposit-limits/

10. Gaurdian. (2013). Switching Banks. Retrieved from https://www.theguardian.com/money/2013/sep/07/switching-banks-seven-day

11. GenPact. (2017). Customer Lifetime Value in Banking. Retrieved from http://www.genpact.com/docs/default-source/resource-/customer-lifetime-value-analytics-in-retail-banking—staying-competitive-and-profitable

12. HBR. (2018). Retrieved from https://hbr.org/2015/06/transparency-trust-and-bitcoin

13. Statista. (2016). Retrieved from https://www.statista.com/statistics/330695/number-of-smartphone-users-worldwide/

14. TD. (2018). Retrieved from https://biz30.timedoctor.com/crazy-high-currency-exchange-fees-how-to-stop-the-banks-from-taking-advantage-of-you/

15. TechCrunch. (2018). Retrieved from https://techcrunch.com/2018/03/07/sec-says-cryptocurrency-exchanges-are-an-unregulated-mess/

16. WSBI. (n.d.). Retrieved from 2017: https://www.wsbi-esbg.org/press/latest-news/Pages/Close-to-40-million-EU-citizens-outside-banking-mainstream.aspx