Mt. Gox

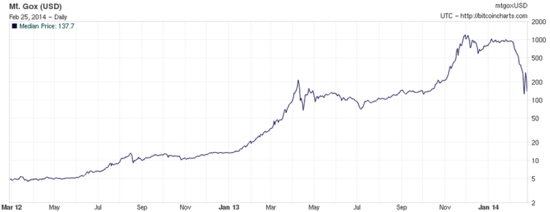

Mt. Gox, called “Mount Gox” or simply “Gox”, was the most widely used bitcoin currency exchange market from shortly after its inception in 2010 to its insolvency late 2013. The market was closed February 25, 2014 and has since filed for bankruptcy protection in Japan and the United States, after losing 640 thousand bitcoins.

A registrant on Mt. Gox had at least two sub-accounts: one for bitcoins (BTC), and one for fiat currency. Bitcoins were bought using funds from the trader’s fiat account, and the proceeds from the sale of bitcoins were deposited into the same account. Trading always involved bitcoins as trading between different national currencies was not offered[1].

Contents

Trades on Mt. Gox’s executed from balances on deposit with the exchange which in turn made trading on the market instantaneous, compared to most other Bitcoin markets of 2010 where a subsequent settlement occurred manually between the trading partners. The disadvantage of this was that a third party had to be trusted with keeping the money safe.

Mt. Gox announced that approximately 850,000 bitcoins belonging to customers and the company were missing and likely stolen, an amount valued at more than $450 million at the time. Although 200,000 bitcoins have since been “found”, the reason(s) for the disappearance—theft, fraud, mismanagement, or a combination of these—were initially unclear. New evidence presented in April 2015 by Tokyo security company WizSec led them to conclude that “most or all of the missing bitcoins were stolen straight out of the Mt. Gox hot wallet over time, beginning in late 2011.”[2]

History

The exchange went online on July 18, 2010.[3]

On October 10, 2010 the exchange switched from PayPal to Liberty Reserve as the main funding option as a result of chargeback fraud. Former PayPal customers still had the possibility to withdraw their USD using alternative methods.

On March 6th, 2011 ownership of the exchange changed hands. Mt. Gox’s new parent, Tibanne, publishes their company certificate from the Japanese government.

On July 19, 2011 a press release announced that Mt. Gox had acquired Mt. Gox Live, a price tracker.

Announced on March 6, 2012 was the Merchant Solution and API[4]

Founding (2006-10)

In late 2006, programmer Jed McCaleb (eDonkey2000, Overnet1, Ripple, Stellar) thought of building a website for users of the Magic: The Gathering Online fantasy-based card game service, to let them trade “Magic: The Gathering Online” cards like stocks. In January 2007, he purchased the domain name mtgox.com, short for “Magic: The Gathering Online eXchange”. Initially in beta release, sometime around late 2007, the service went live for approximately three months before McCaleb moved on to other projects, having decided it was not worth his time. He reused the domain name in 2009 to advertise his card game The Far Wilds.[5]

In July 2010, McCaleb read about bitcoin on Slashdot, and decided that the bitcoin community needed an exchange for trading bitcoin and regular currencies. After writing an exchange website, he launched it while reusing the spare mtgox.com domain name. On July 18, Mt. Gox launched its exchange and price quoting service deploying it on the spare mtgox.com domain name.

Security breach and invalid addresses (2011)

McCaleb sold the site to French developer Mark Karpelès, who was living in Japan, in March 2011, saying “to really make mtgox what it has the potential to be would require more time than I have right now. So I’ve decided to pass the torch to someone better able to take the site to the next level.”[6]

On 19 June 2011, a security breach of the Mt. Gox bitcoin exchange caused the nominal price of a bitcoin to fraudulently drop to one cent on the Mt. Gox exchange, after a hacker allegedly used credentials from a Mt. Gox auditor’s compromised computer to transfer a large number of bitcoins illegally to himself. He used the exchange’s software to sell them all nominally, creating a massive “ask” order at any price. Within minutes the price corrected to its correct user-traded value. Accounts with the equivalent of more than $8,750,000 were affected. In order to prove that Mt. Gox still had control of the coins, the move of 424,242 bitcoins from “cold storage” to a Mt. Gox address was announced beforehand, and executed in Block 132749.[7]

In October 2011, about two dozen transactions appeared in the block chain (Block 150951) that sent a total of 2,609 BTC to invalid addresses. As no private key could ever be assigned to them, these bitcoins were effectively lost. While the standard client would check for such an error and reject the transactions, nodes on the network would not, exposing a weakness in the protocol.

Processor of most of world’s bitcoin trades; issues (2013)

On 22 February 2013, following the introduction of new anti-money laundering requirements by e-commerce/online payment system company Dwolla, some Dwolla accounts became temporarily restricted. As a result, transactions from Mt. Gox to those accounts were cancelled by Dwolla. The funds never made it back to Mt. Gox accounts. The Mt. Gox help desk issued the following comment: “Please be advised that you are actually not allowed to cancel any withdrawals received from Mt. Gox as we have never had this case before and we are working with Dwolla to locate your returned funds.” The funds were finally returned on May 3, nearly three months later, with a note: “Please be advised never to cancel any Dwolla withdrawals from us again”[8].

In March 2013, the bitcoin transaction log or “blockchain” temporarily forked into two independent logs, with differing rules on how transactions could be accepted. The Mt. Gox bitcoin exchange briefly halted bitcoin deposits. Bitcoin prices briefly dipped by 23%, to $37, as the event occurred, before recovering to their previous level (approximately $48) in the following hours.

By April 2013 and into 2014 the site had grown to the point where it was handling over 70% of the world’s bitcoin trades, as the largest bitcoin intermediary and the world’s leading bitcoin exchange. With prices increasing rapidly, Mt. Gox suspended trading from 11–12 April for a “market cooldown”. The value of a single bitcoin fell to a low of $55.59 after the resumption of trading, before stabilizing above $100. Around mid-May 2013, Mt. Gox traded 150,000 bitcoins per day, per Bitcoin Charts.

On 2 May 2013 CoinLab filed a $75 million lawsuit against Mt. Gox, alleging a breach of contract. The companies had formed a partnership in February 2013 under which CoinLab was to handle all of Mt. Gox’s North American services. CoinLab’s lawsuit contended that Mt. Gox failed to allow it to move existing U.S. and Canadian customers from Mt. Gox to CoinLab.

On 15 May 2013 the US Department of Homeland Security (DHS) issued a warrant to seize money from Mt. Gox’s U.S. subsidiary’s account with payment processor Dwolla]. The warrant suggested the US Immigration and Customs Enforcement, an investigative branch of the DHS, asserted that the subsidiary, which was not licensed by the US Financial Crimes Enforcement Network (FinCEN), was operating as an unregistered money transmitter in the US. Between May and July the DHS seized more than $5 million from the subsidiary. On 29 June 2013, Mt. Gox received its money services business (MSB) license from FinCEN.

Mt. Gox suspended withdrawals in US dollars on June 20, 2013. The Mizuho Bank branch in Tokyo that handled Mt. Gox transactions pressured Mt. Gox from then on to close its account. On July 4, 2013, Mt. Gox announced that it had “fully resumed” withdrawals, but as of September 5, 2013, few US dollar withdrawals had been successfully completed.[9]

On August 5, 2013, Mt. Gox announced that it incurred “significant losses” due to crediting deposits which had not fully cleared, and that new deposits would no longer be credited until the funds transfer was fully completed.

Wired Magazine reported in November 2013 that customers were experiencing delays of weeks to months in withdrawing cash from their accounts. The article said that the company had “effectively been frozen out of the U.S. banking system because of its regulatory problems”.

Withdrawals halted; trading suspended; bitcoin missing (2014)

Customer complaints about long delays were mounting as of February 2014, with more than 3,300 posts in a thread about the topic on the Bitcoin Talk online forum.

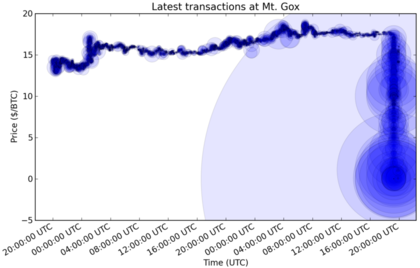

On 7 February 2014, Mt. Gox halted all bitcoin withdrawals. The company said it was pausing withdrawal requests “to obtain a clear technical view of the currency processes”. The company issued a press release on February 10, 2014, stating that the issue was due to transaction malleability: “A bug in the bitcoin software makes it possible for someone to use the bitcoin network to alter transaction details to make it seem like a sending of bitcoins to a bitcoin wallet did not occur when in fact it did occur. Since the transaction appears as if it has not proceeded correctly, the bitcoins may be resent. Mt Gox is working with the bitcoin core development team and others to mitigate this issue.”

On 17 February 2014, with all Mt. Gox withdrawals still halted and competing exchanges back in full operation, the company published another press release indicating the steps it claimed it was taking to address security issues. In an email interview with the Wall Street Journal, CEO Mark Karpelès refused to comment on increasing concerns among customers about the financial status of the exchange, did not give a definite date on which withdrawals would be resumed, and wrote that the exchange would impose “new daily and monthly limits” on withdrawals if and when they were resumed.

On 20 February 2014, with all withdrawals still halted, Mt. Gox issued yet another statement, not giving any date for the resumption of withdrawals.

On 23 February 2014, Mt. Gox CEO Mark Karpelès resigned from the board of the Bitcoin Foundation. The same day, all posts on its Twitter account were removed.[10]

On 24 February 2014, Mt. Gox suspended all trading, and hours later its website went offline, returning a blank page. A leaked alleged internal crisis management document claimed that the company was insolvent, after having lost 744,408 bitcoins in a theft which went undetected for years.

Six other major bitcoin exchanges released a joint statement distancing themselves from Mt. Gox, shortly before Mt. Gox’s website went offline.

On 25 February 2014, Mt. Gox reported on its website that a “decision was taken to close all transactions for the time being”, citing “recent news reports and the potential repercussions on Mt Gox’s operations”. Chief executive Mark Karpelès told Reuters that Mt. Gox was “at a turning point”.

From 1 February 2014 until the end of March, during the period of Mt. Gox problems, the value of bitcoin declined by 36%.

Bankruptcy; stolen bitcoin (2014–16)

On 28 February 2014 Mt. Gox filed in Tokyo for a form of bankruptcy protection from creditors called minji saisei (or civil rehabilitation) to allow courts to seek a buyer, reporting that it had liabilities of about 6.5 billion yen ($65 million, at the time), and 3.84 billion yen in assets.

The company said it had lost almost 750,000 of its customers’ bitcoins, and around 100,000 of its own bitcoins, totaling around 7% of all bitcoins, and worth around $473 million near the time of the filing. Mt. Gox released a statement saying, “The company believes there is a high possibility that the bitcoins were stolen,” blamed hackers, and began a search for the missing bitcoin.[11] Chief Executive Karpelès said technical issues opened up the way for fraudulent withdrawals.

Mt. Gox also faced lawsuits from its customers.

On 9 March 2014, Mt. Gox filed for bankruptcy protection in the US, to halt U.S. legal action temporarily by traders who alleged the bitcoin exchange operation was a fraud.

On 20 March 2014, Mt. Gox reported on its website that it found some bitcoins — worth around $116 million — in an old digital wallet used prior to June 2011. That brought the total number of bitcoins the firm lost down to 650,000, from 850,000.

New evidence presented in April 2015 by Tokyo security company WizSec led them to conclude that “most or all of the missing bitcoins were stolen straight out of the Mt. Gox hot wallet over time, beginning in late 2011.”

On April 14, Mt. Gox lawyers said that Karpelès would not appear for a deposition in a Dallas court, or heed a subpoena by FinCEN.

On 16 April 2014, Mt. Gox gave up its plan to rebuild under bankruptcy protection, and asked a Tokyo court to allow it to be liquidated.

In a 6 Jan 2015 interview, Kraken bitcoin exchange CEO Jesse Powell discussed being appointed by the bankruptcy trustee to assist in processing claims by the 127,000 creditors of Mt. Gox.

CEO Karpelès was arrested in August 2015 by Japanese police and charged with fraud and embezzlement, and manipulating the Mt. Gox computer system to increase the balance in an account — this charge was not related to the missing 650,000 bitcoins.[12]

By May 2016, creditors of Mt. Gox had claimed they lost $2.4 trillion when Mt. Gox went bankrupt, which they asked be paid to them. The Japanese trustee overseeing the bankruptcy said that only $91 million in assets had been tracked down to distribute to claimants, despite Mt. Gox having asserted in the weeks before it went bankrupt that it had more than $500 million in assets. The trustee’s interim legal and accounting costs through that date, to be paid ultimately by creditors, were $5.5 million.

Trading

Buying and selling

A buy order was executed partially or in full when the price bid could be matched against a sell order that was at or below the bid amount. A sell order was executed partially or in full when the price asked could be matched against a buy order that was at or above the ask amount. Orders that could not be matched immediately remain in the orderbook.

Unfunded orders did not appear in the order book, but were automatically inserted when a deposit was credited. For example, Mt. Gox allowed the entry of a “buy” order even if the account had insufficient funds. If possible, Mt. Gox would execute a portion of the order if it could be partially funded. If a deposit was later credited and the deposit resolves the insufficient funds status of an outstanding order, the order would be immediately activated, and if possible, executed.

Fees

Mt. Gox charged a trading fee of up to 0.6% from each party of successful trades made through the market. The fee appeared in the account history next to each trade. The trading fee was discounted for larger customers based on volume, which was calculated as a sliding window over the last 720 hours (30 days).

The fees were, by default, subtracted from the proceeds of each trade (e.g., a buy of 1.0 BTC will add to the account balance 0.994 BTC when the exchange fee is 0.6%). An account setting would allow fees to be added to the purchase amount instead (e.g., buying 1.0 BTC at $5 will cost about $5.03 when the exchange fee is 0.6%).

External links

- Mt. Fox Official website

- MtGox Co., Ltd. bankruptcy docket from the United States Courts Archive

- Mt. Gox – Wikipedia.org

See Also on BitcoinWiki

- Buying bitcoins

- Bitfinex, which replaced Mt. Gox as the world’s largest bitcoin exchange, lost $72 million in bitcoin in 2016.

- Bitpay

- BTCC

- CoinDesk

References

- ↑ World’s Leading Bitcoin Exchange, Mt.Gox, acquires MtGoxLive.com

- ↑ The missing MtGox bitcoins

- ↑ MtGox announcement on forum

- ↑ Mt.Gox launches the definitive bitcoin checkout solution

- ↑ The Far Wilds: Free Online Strategy Game

- ↑ Jed McCaleb. “Mtgox is changing owners”. Bitcointalk Bitcoin Forum: Economy: Marketplace: Service Discussion, 6 March 2011. Accessed 23 October 2016.

- ↑ Block 132749 – Bitcoin Block Explorer

- ↑ Mtgox is changing owners

- ↑ Bitcoin operator Mt. Gox resumes withdrawals

- ↑ MtGox Resigns From Bitcoin Foundation, Deletes All Tweets From Twitter Feed

- ↑ Mt. Gox Seeks Bankruptcy After $480 Million Bitcoin Loss, Carter Dougherty and Grace Huang, Bloomberg News, Feb. 28, 2014

- ↑ https://www.ft.com/content/84311a60-5868-11e5-9846-de406ccb37f2 Subscribe to read