Rebittance

Bitcoin remittance (Rebittance) is a term that is being increasingly used to distinguish Bitcoin remittance from traditional remittance. It is the process of using Bitcoin companies for remittance of money overseas in a manner familiar with those who use traditional remittance companies, but at a fraction of the cost.

Contents

What is Remittance?

In 2014, an expected US $436 Billion will be remitted by migrants back to their families in the developing world. The cost of sending all those remittances is estimated at US $47 billion or more than 10% of the entire amount.

In traditional remittances, credit is forwarded through 3 or 4 separate banks or clearing houses before finding their way to their intended recipients. At each step, fees may be applied. Each bank must secure its respective network and facilities and this costs money[1].

By using Bitcoin, the average cost of remittances could be reduced to $5 Billion, or 1.1%.

How Does Bitcoin Remittance Work?

Bitspark, a bitcoin remittance company based in Hong Kong, is offering services to send money to countries like the Philippines, Indonesia and Vietnam. It offers a cloud-hosted solution for MTOs in developing nations that works seamlessly with little to no banking infrastructure.

Through a simple internet connection and free software/app running on a suitable device, MTOs are able to send and receive a customer’s money without any additional overhead fees for installation, maintenance, and subscription charges. All the details of the transactions, including the customer’s KYC (Know Your Customer) and other anti-money laundering necessities, are stored in a secure and low-cost database, which may also be a blockchain.

The businesses simply make an estimate of the amount of money needed for a day or for a particular remittance, purchase equivalent bitcoins in advance, and immediately sell them for the fiat currency in the receiving nation. The business is almost free of any risk as it does not hold the virtual currency tokens for a long period of time, and customers’ transactions are performed within minutes.

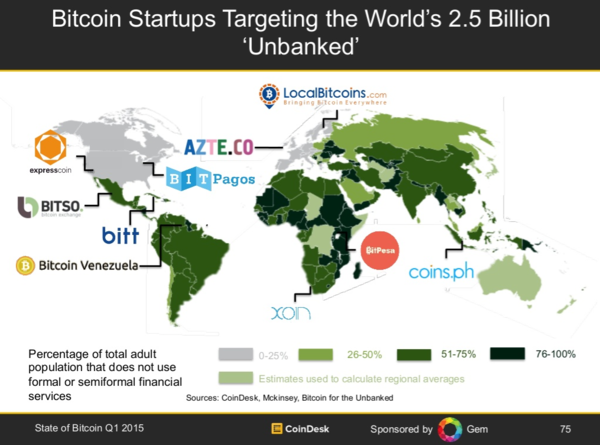

Articles about FinTech-Bitcoin-blockchain are often trying to invoke “unbanked” “poor” or “women” as the reason and special focus for money transfer startups. Instead of simply acknowledging that these startups are primarily founded to make money and accumulate market power, we are asked to believe in their higher calling. Not surprisingly, such articles are always missing two critical components which would make those claims believable: 1) specifics on targeting such segments, 2) explanation on how to make money with such targeting[2].

Remittance Services

Rebittance does away with all this by only having a single entity in between the sender and the receiver. Although Bitcoin is inherently designed to be completely peer-to-peer, Rebittance companies are seen as a necessity due to lack of infrastructure at this stage of its development. These organizations purchase bitcoins from senders all over the world and then exchange and remit the local currency to the nominated recipient. Bitcoin remittance companies have reduced the cost of sending money internationally from a global average of about 8% to anywhere from 3% to 1%.

These are the Bitcoin remittance companies to date:

Rebittance.org

In October of 2014, the website Rebittance.org was created by Philippines-based company Satoshi Citadel Industries as a shared resource about Bitcoin remittance for the bitcoin community.

External Links

http://Rebittance.org website

References

- ↑ http://bitcoin.it/

- ↑ https://www.saveonsend.com/blog/bitcoin-blockchain-money-transfer/ Does Bitcoin/Blockchain make sense for international money transfers?