Bitcoin Supply

Total bitcoin supply is limited – there can be no more than 21 million coins in circulation. This restriction was spelled out in the first version of the protocol. The more people start using bitcoins, the higher the price will be for a fixed offer. The price fluctuates, including because the number of people using bitcoin is still relatively small. The total value of the platform will grow with an increase in the number of users.

At the beginning of 2011, less than one US dollar was offered for one BTC, and at the beginning of 2017, the price exceeded one thousand dollars. In August 2019, the price of bitcoin amounted to almost 12 thousand dollars.

Not all bitcoins are mined yet, that is, the offer is actually growing. To maintain the price, the dynamics of growth in demand for cryptocurrency must correspond to the dynamics of growth in supply in order to maintain a stable price.

The Bitcoin exchange rate will increase with the growth of the audience and its confidence in the digital currency. The audience includes ordinary users, entrepreneurs, and technological blockchain startups. As with any currency, the value of BTC is determined by the willingness of people to accept it as a means of payment.

So, bitcoin pricing is determined by traditional market mechanisms. It is also necessary to remember that the max bitcoin supply is 21,000,000.

Contents

How Many Bitcoins Have Been Mined Already

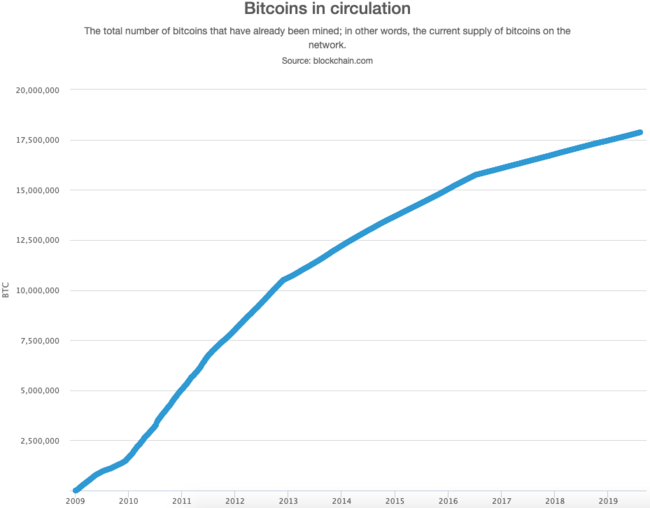

In August 2019 there are about 17,800,000 bitcoins in circulation according to the Blockchain.[1] It seems that Bitcoin (BTC) has 85% of its supply already in circulation.

Knowing about the limited number of Bitcoins, miners throw all their resources into production, spend earned money, and use the capabilities of mining organizations to the full extent.

Approximately 3,000 coins are added to the currency network daily. New arrivals cost users more and more expensive. Users will be able to reach the upper limit by around 2140 – this is the year when the last bitcoin will be mined. Such a decrease in speed is due to the following reasons:

- Requirements for the used devices produced by the currency are constantly growing.

- Significantly increases the time required to mine one Bitcoin.

The situation is further complicated by the fact that modern mining companies focused on the extraction of new coins invest large sums to purchase new expensive equipment. Such organizations calculate as accurately as possible how many coins they need and how much time it will take to return the invested funds.

Bitcoin Max Supply

The maximum number of cryptocurrency coins that can be mined for all time is 21 million units. Currently, users received approximately 85% of the total. Each coin received is solvent. A currency, unlike conventional monetary units, is not backed by gold and debt, but solely by supply and demand.

Professionals note that the ever-increasing value of Bitcoin is based on the number of resources spent that are required to obtain each individual coin.

In some cases, the currency is provided by the price of the goods, which is set by the seller, as well as the price offered by the buyer.

Why is the Number of BTC Coins is Limited

Limiting the release of Bitcoin does not allow cryptocurrency to depreciate. However, many are interested in where the figure of 21 million coins came from? This limitation is associated with the reward formulas for miners, which are created on the basis of the law of inverse geometric progression. Simply put, the existing principles for generating bonuses to token miners do not allow mathematically to step over the 21 million BTC line. The maximum emission is 20,999,999.9769 BTC. There is an opinion that the creators of Bitcoin limited themselves to such an issue emission for a reason. The number of coins was chosen for the prospect of full integration of BTC into the global economy. At the time of the creation of the cryptocurrency, the total amount of money that existed in the world was 50 trillion USD. Against this background, 21 million seems to be a small number. However, such an issue would be enough even to replace fiat money completely. If you carry out a direct exchange of 50 trillion USD for the issue of Bitcoin, you get 2,381,000 BTC. In this case, one Satoshi would be equal to 2.381 cents. This means that the selected issue would be enough to service the global economy.

How Many People Own Bitcoin

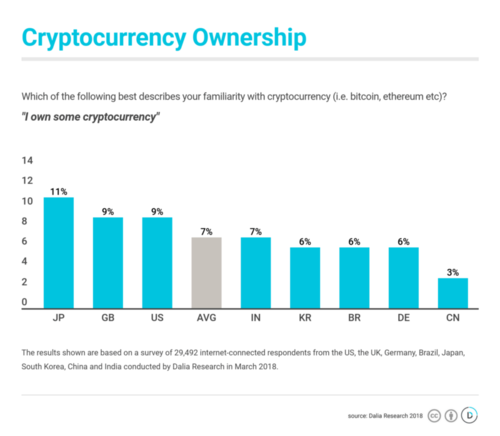

According to research at the time of 2019, almost three-quarters of all respondents said they had at least heard about cryptocurrencies. Given that just a few years ago, cryptocurrencies were little known, this is a definite breakthrough. For the study, the Dalia resource was used, which made it possible to interview more than 29,000 people from the eight largest cryptocurrency markets (USA, UK, Germany, Brazil, Japan, South Korea, China, and India).

The results show that South Korea (87%) and Japan (83%) are most advanced in terms of awareness of cryptocurrencies. Other large western markets (USA, UK, Germany) also have a high indicator of about 75%, in Brazil this figure is above 60%.

It turned out that out of more than 29,000 respondents connected to the Internet, about 7% say they own a small number of cryptocurrencies. This confirms that crypto assets are not only a media phenomenon, but also belong to a certain part of the population. The number of owners is greater than those who want to buy, which suggests that the community of the first supporters has already formed. In the near future, it is expected to continue the complication of mining and reduce the reward for new blocks. Already today, profitable coin mining is possible only through ASIC. According to many experts, the future of mining BTC for large mining pools. The forecast is disappointing for the “loners” – they will have to leave the market since the extraction of coins by using small computing power will become unprofitable. Partially change the situation can increase the reward for processing transactions. This is the most pessimistic scenario, but there are other opinions.