Stablecoin

Stablecoin is referred to as a cryptocurrency who’s value is pegged to an underlying asset. Such an underlying asset could be for example a fiat currency, such as the US Dollar. A stablecoin is an asset that offers price stability characteristics. In order to provide such a stable value it is usually necessary to back the stablecoin with a collateral.[1]

The majority stablecoins are pegged against the USD, but some tokens use a basket of currencies or an index such as a consumer price index as the underlying asset. Typical use cases for stablecoins are prediction markets or future contracts.[2]

Contents

Stablecoins Explained

Price volatility was mentioned by numerous blockchain experts as one of the main factors that are preventing a wide spread adoption of cryptocurrencies. Even for the biggest cryptocurrencies such as Bitcoin or Ethereum it is normal to fluctuate 50% in value compared to the US Dollar.

This high price volatility is preventing cryptocurrency from being used in a number of occasions such as:

- Payments: People are reluctant to pay goods of their daily need in a currency the fluctuates a lot. The same can be observed with fiat currencies in developing countries that are subject to high inflation. In these countries the dollar is often used as the unofficial currency.

- Loans: Investors are reluctant to lend money to debtors if they can not be certain of the value of the money once they get it back.

- Store of Value: People and organizations that do not want to engage in risky behavior do not wish to keep their resources in a currency that fluctuates heavily in value.

Stablecoins are tackling exactly the problems mentioned above by providing a stable value to investors and users.

Types of Stablecoins

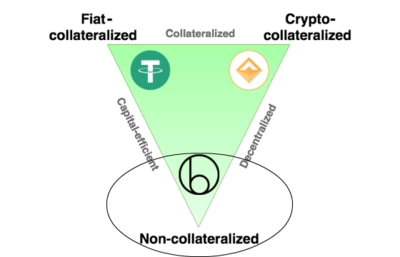

There are two types of Stablecoins:

- Stablecoins that are backed by the asset it’s pegged to. These are legally-backed stablecoins. If ever something goes wrong, holders of this type of stablecoins are legally entitled to the underlying assets.

- Stablecoins that are kept stable in comparison to the price of the asset but do not represent ownership of the asset. This type of stablecoin is kept stable through ingenuous, complex systems that prevent divergence between the price of the asset and the stablecoin.

List of Stablecoins

Current attempts to build a stablecoin include the following projects:

- 1SG

- Alchemint Standards

- BitCNY

- BitEUR

- BitUSD

- Constant

- Dai

- Gemini Dollar

- NuBits

- Paxos Standard Token

- QUSD

- Reserve Rights

- SDUSD

- Sparkdex.HKD

- Stable.PHP

- StableUSD

- STASIS EURS

- sUSD

- Tether

- TrueUSD

- USD Coin

- USDCoin

- White Standard

Benefits

Stablecoins have the potential to boost the use of cryptocurrencies and push them into mainstream usage. This is due to the absence of the enormous price volatility which most cryptos are susceptible to while leveraging the benefits of blockchain technology.

This major benefit is particularly well-demonstrated in the remittance market. Remittances are financial transactions made by people who work overseas who send their wages home to their families. This large financial sector is highly inefficient due to the high cost of these remittances; and it’s the users who suffer as their wages are eaten up by high transaction costs.

Drawbacks

For investors and traders, stablecoins provide a safe haven during a market crash without having to transfer their capital back to fiat currencies. Through stablecoins, this protection can be executed within minutes without having to deal with issues related to fiat currencies such as:

- Lack of fiat currency support in exchanges: Only a few exchanges support fiat currencies due to strict regulations. However, transacting with stablecoins is much easier to allow for.

- Slow transaction times: Sending fiat back and forth between your bank accounts takes days.

- Regulations limiting crypto transactions: Banks are cracking down on crypto-related transactions, meaning that overnight you could be prevented from sending money to a crypto-related company.

Additionally, stablecoins allow decentralized exchanges to create crypto-fiat trading pairs. Onramps for fiat to decentralized exchanges have been proven to be extremely difficult as most financial companies don’t want to get connected with these exchanges.

External links

- Investinblockchain – What is Stable coin?

- The Holy Grail cryptocurrency

- Invest Rating – Financial encyclopaedia – Stablecoin

- Hackernoon

- Coinmarketcap

- Wikipedia

- Cointelegraph

- Bitcointalk

- Forum

- [1]

References

- ↑ The Merkle – What is a Stablecoin: https://themerkle.com/what-is-a-stablecoin/

- ↑ Coin Journal – The Rise of Stablecoins: https://coinjournal.net/the-rise-of-stablecoins/